Duncan Frearson of Smith Street Capital puts it well:

Duncan Frearson of Smith Street Capital puts it well:

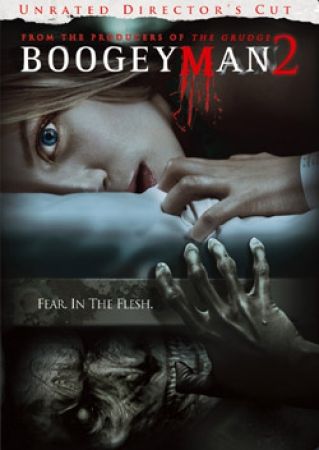

Anyone who has kids knows when the lights go out, the boogey man appears. We are in the unfortunate position where problems in Europe, the end of some government stimulus programs, some large budget gaps and a growing oil leak have turned off the market’s lights. The boogey man has entered the mind of the market causing some fearful behavior.

Investors and fund managers are clearly in panic mode. We are not in a double dip, and there are no real indications we are going into one but the fear of renewed recession has sent investors stampeding into oil, out of oil, into copper, out of copper into gold, out of gold ($1,186 today), in and out of the Nasdaq, AAPL, Small Caps, Financials… on and on and on with virtually no actual changes in earnings or outlook from any sector other than the general trend of SLOWLY improving conditions.

Panic is easy to provoke. Get 5 people to act crazy outside a store and tell them the whole town has gone nuts and they need to shut the windows and turn out the lights. Once they listen to you, take your show to the next store but now you can point to the first store as an example of the panic that is on the streets. By the time you get half a dozen stores (think funds) to panic, you don’t even have to do your little show anymore, people just see store shutting down and they ask them what’s up and rumors take on a life of their own and, before you know it, the whole town is in a panic over nothing real at all.

"At the end of the day", Frearson continues, "the earnings power of a company is all that matters and thus understanding customer behavior is paramount. For the economy as a whole we should ask ourselves: are we currently spending beyond our means? Individuals are earning at record levels – around $10,103 billion for real disposable personal income in Q2 and we are only just beginning to push real spending beyond Q4 2007 levels leading to a savings rate in the 3.5% range, according to government data. The debt service coverage ratio and the financial obligations ratio both indicate the consumer is de-leveraging into a more stable financial foundation."

Last month, the ECRI’s Short-Term Index turned down and pushed the fear levels to new highs. Zero Hedge’s title was "ECRI Leading Economic Index Drops To 44 Week Low, Predicts Massive Economic Contraction" and the WSJ said it was "Confirming A Sense Of Gloom" but the Managing Director of the ECRI said (in the comments of the WSJ article, that nobody reads):

The purported false alarms from “the ECRI” mentioned in this article [WSJ article] come from a mistaken and simplistic view that negative growth in ECRI’s Weekly Leading Index (WLI) is tantamount to a recession forecast. In fact, since 1983, cyclical downturns have taken WLI growth under the zero line a dozen times, but recessions have followed on only three of those occasions – times when ECRI actually made a recession forecast.

Since ECRI itself has never used WLI growth going negative as a recession signal, it is important that such “false alarms” are attributed not to ECRI or even to the WLI, but to what is a mistaken interpretation of the WLI.

In fact, at the very least, ECRI itself would need to see a “pronounced, pervasive and persistent” decline in the level of the WLI (not merely negative readings in its growth rate) following a “pronounced, pervasive and persistent” decline in ECRI’s U.S. Long Leading Index (not discussed in the article), before it makes a recession call.

What the LONG-TERM ECRI Indicators are showing is this:

Meanwhile, it’s 8:30 and, once again Mohammed El-Erain has the floor on CNBC for an extended period and he says "the new normal" is a World of dismal failure and contraction as nation after nation tightens their belt to make sure they have enough money to pay back the $1Tn he lent them. That’s the sunshine report for our pre-market. At 5am, for Europe’s open, CNBC has a special guest too, who got out of bed early and spent the whole hour with them. He was kind of gloomy too but that’s not surprising as he was Arnab Das, the managing director of Global Economics. Who is Global Economics? Why that’s Roubini’s firm!

See, Phil – they don’t have Roubini and El-Erian on CNBC EVERY time they are trying to panic the market, sometimes they have El-Erian and Roubini’s Managing Director or sometimes it’s Gross and Roubini and sometimes it’s Greenspan (now on Pimpco’s payroll) and one of the above so please, PLEASE don’t say they always have Roubini and El-Erian trying to frighten the markets – that’s just not true…

See, Phil – they don’t have Roubini and El-Erian on CNBC EVERY time they are trying to panic the market, sometimes they have El-Erian and Roubini’s Managing Director or sometimes it’s Gross and Roubini and sometimes it’s Greenspan (now on Pimpco’s payroll) and one of the above so please, PLEASE don’t say they always have Roubini and El-Erian trying to frighten the markets – that’s just not true…

How long can the Gloom and Doom squad keep the market back on it’s heels? Frearson postulates that the longer stability is maintained, the more consumers will feel comfortable about increasing their spending. Ironically, U.S. states are increasing general fund expenditures in their FY 2011 budgets to $635.3 billion from $612.9 billion in FY 2010, according to the National Governors Association. Increased tax revenue from improving economic activity, the usage of remaining American Recovery Act Funds and “rainy day” funds will help stabilize a recovery. Confidence is slowly returning as employment stabilizes. Gallup polls suggest higher income consumers are beginning to spend more and this will filter down to middle income and eventually to lower income consumers even in light of the declining equity markets due to restructured personal balance sheets. Companies, in turn, will respond with increased production, inventory rebuilding and increased hiring.

Let’s keep in mind that our beloved Fed Chairman, Ben Bernanke, has already printed more money in the past for years than this country created in the first 230 years. That money is sitting in bank vaults and on corporate balance sheets and tied up in shiny bits of metal and speculative gold futures and zero-interest TBills and it is ANXIOUS to seek a better rate of return once the fear and panic subside but, that would be catastrophic for Pimco, who loaned out $1Tn at fairly low interest and that would be bad for GE, who borrowed $500Bn at very low interest rates so they will use ALL of their influence to keep those rates as low as possible for as long as possible.

The Fed is bailing out banks and bailing out companies like GE by either buying up their assets WITH YOUR MONEY at face value (40% over market) and they are lending companies like GE YOUR MONEY at 0.25% interest while you continue to pay 5% interest on your home loan. Isn’t that ridiculous? Of course it is. But you put up with it because you are scared! You are scared because GE tells you to be scared through their TV network – you will do anything to avoid things getting worse, even when anything includes submitting to repeated corporate gang rapes that affect you now, in your future and in the future of your children and their children.

Wake up America – this is pathetic!

Asia and Europe turned down a bit but not too much. What does it matter, though? Fundamentals are not relevant at the moment. Nothing matters until investors grow a spine and I’m not counting on that! We have our disaster hedges and we had a lot of fun riding that pullback yesterday with DIA puts and this morning we have 10 new well-hedged entries on some of the beaten-down Dow components we looked at in yesterday’s post so bring it on markets – you keep panicking and we’ll keep buying!

Be careful out there…