Courtesy of Mish

Following Threats of Troika Surveillance and Inspectors Headed to Italy to Verify the Italian Books it should be no surprise to find Italian bond spreads and yields surging to new highs.

Italy 10-Year Government Bond Yield

Italy 2-Year Government Bond Yield

Germany 10-Year Government Bond Yield

Germany 2-Year Government Bond Yield

European Sovereign Debt Spread Table 10-Year Bonds

| Country | 10-Yr Yield | Spread vs. Germany |

|---|---|---|

| Germany | 1.82 | 0.00 |

| France | 3.05 | 1.23 |

| Belgium | 4.38 | 2.56 |

| Spain | 5.58 | 3.76 |

| Italy | 6.37 | 4.55 |

| Ireland | 8.21 | 6.39 |

| Portugal | 11.88 | 10.06 |

| Greece | 26.77 | 24.95 |

European Sovereign Debt Spread Table 2-Year Bonds

| Country | 2-Yr Yield | Spread vs. Germany |

|---|---|---|

| Germany | 0.40 | 0.00 |

| France | 1.08 | 0.68 |

| Belgium | 2.69 | 2.29 |

| Spain | 4.25 | 3.85 |

| Italy | 5.46 | 5.06 |

| Ireland | 9.19 | 8.79 |

| Portugal | 20.14 | 19.74 |

| Greece | 97.97 | 97.57 |

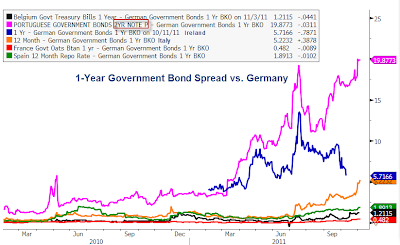

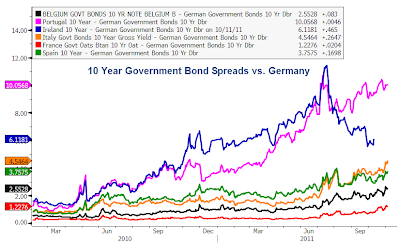

Inquiring minds might be interested in what European spreads look like over time. Chris Puplava at Financial Sense graciously put together a few charts at my suggestion that shows this action. Thanks Chris!

10-Year Spreads vs. Germany Over Time

click on chart for sharper image

Recent Record Highs: Italy, Belgium, France

1-Year Spreads vs. Germany Over Time

click on chart for sharper image

Recent Highs: Portugal, Italy, France, Belgium, Spain

Note: Portugal does not have 1-year bonds. 2-year bond yield substituted

10-Year Minus 2-Year Yields, by Country

click on chart for sharper image

That massive inversion in Portuguese bonds with the 10-Year bond yield at 11.88% and the 2-year bond yield at 20.14% is a sign Portugal may blow sky high any time. Ireland recovered from a similar setup, Portugal failed to do so.