The madness continues.

The madness continues.

I don't have much that's new to say as I've said it all since Thanksgiving, when I warned that Omicron, Labor Unrest and Inflation were brewing a toxic combination, saying:

We're watching the Russell 2,000 closely this week as that index is down 10% from the highs and back to where it's been flat-lining all year. 2,200 is the line to watch and below that, there is not much support all the way back to 1,500, which would be a 33% correction from here – very unpleasant.

So, if the Russell breaks, look for the other indexes, which are only about 2.5% off their highs, to begin catching up and that could get very ugly, very fast and that means we need to be very sensitive to signs of worsening news as a warning to add more hedges. We went over the levels to watch on each of the indexes in yesterday's Live Member Chat Room.

As you can see, the Russell has fallen 16.8% since November but that was not the high, the high for the Russell was 2,460 on November 8th and yesterday's low was 1,925, 21.7% off the high. This morning we are testing the 2,000 line from below and, as before, which side of the line the Russell is on is likely to determine the direction of the markets going forward but, if I was right in late November, the real bottom could be a lot lower than this.

As you can see, the Russell has fallen 16.8% since November but that was not the high, the high for the Russell was 2,460 on November 8th and yesterday's low was 1,925, 21.7% off the high. This morning we are testing the 2,000 line from below and, as before, which side of the line the Russell is on is likely to determine the direction of the markets going forward but, if I was right in late November, the real bottom could be a lot lower than this.

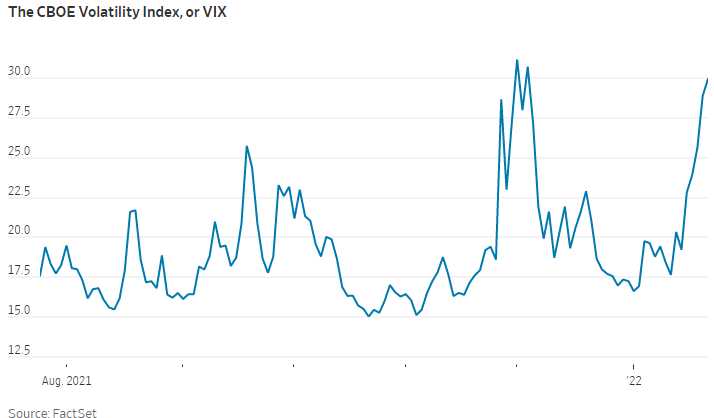

GE lost $3.8Bn this morning and RTX missed expectations but 3M (MMM), who make the masks, are up 1.4% pre-market with better-than-expected earnings. The VIX is as high as it was during the December dip, when the Russell fell 15%, to 2,150 and 15% below that would be 1,827.50 – only 100 points below yesterday's low.

GE lost $3.8Bn this morning and RTX missed expectations but 3M (MMM), who make the masks, are up 1.4% pre-market with better-than-expected earnings. The VIX is as high as it was during the December dip, when the Russell fell 15%, to 2,150 and 15% below that would be 1,827.50 – only 100 points below yesterday's low.

If we keep getting these anemic earnings reports, investors are going to start questioning the valuations that are being asked – even after the recent round of discounting. Omicron is everyone's excuse but it's the lack of stimulus that's showing us how damaged the economy really is for the fist time in 2 years.

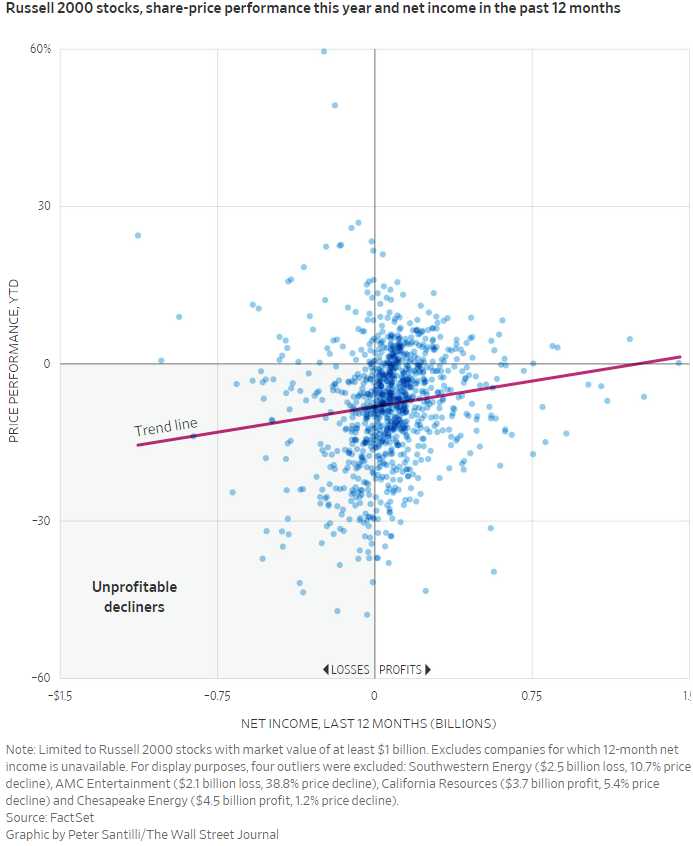

The "shocking" headline in the Wall Street Journal this morning is "Investors Lose Appetite for Stocks of Unprofitable Companies," noting that 1/3 of the 3,000 companies in the Russell Indexes do not make a profit. Combining no profits with rising interest rates to borrow money for more losses is not going to give you a robust index – even with the current generation of unicorn-chasing investors. You can try to blame Omicron but this is a 12-month view of the price-performance ration for the small-cap Russell 2000 and it's not pretty:

Now the Russell hasn't gone up much in price for the past year but the underlying earnings have weakened as all that stimulus has worn out and, unlike large-cap companies, Russell 2000 companies cannot easily juggle their books to call up any earnings they wish to report.

We'll see how the earnings come in and we'll see where we come out on our new bounce chart, which plots what WILL be the next leg of the correction if the current levels fail:

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong). We were below our predicted 33,120 mid-point at yesterday's lows.

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong) is where we are this morning (again).

- Nasdaq is using 13,500 as the base and we bottomed yesterday at 13,706. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,780 (weak) and 1,960 (strong).

So not much green on our bounce chart and ANY red on a chart which shows a 20% correction that hasn't happened yet is very bad indeed but that's how this chart is supposed to work – it's a quick warning indicator that tells us when it's time to hedge – or when it's time to buy (a LOT more green than this!).

"Waiting to cut out the deadwood

Waiting to clean up the city

Waiting to follow the worms

Waiting to put on a black shirt

Waiting to weed out the weaklings

Waiting to smash in their windows

And kick in their doors

Waiting for the final solution

To strengthen the strain" – Pink Floyd

Ah Capitalism…