Was that the Bottom?

Stocks got washed out in the third quarter. Whether you were looking at prices or people’s reactions to said prices, it was hard to find anything positive to say other than things are so bad they’re actually good.

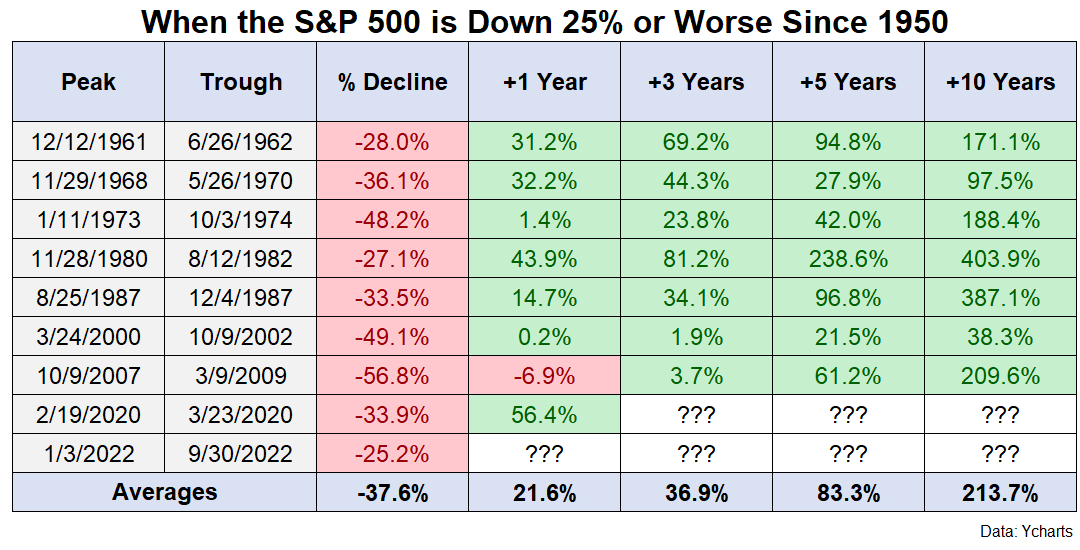

That might sound silly, but it’s not. It’s the truth. The riskier stocks feel, the less risky they get over time. And I cannot emphasize “over time” enough. Because sometimes stocks fall a lot and then they crash. But full-blown crashes are not common, and while it’s important to be aware of them, they should not be anyone’s base case. If you think every bear market leads to a global crisis, you’re going to have awful long-term returns and a ton of anxiety on top of it.

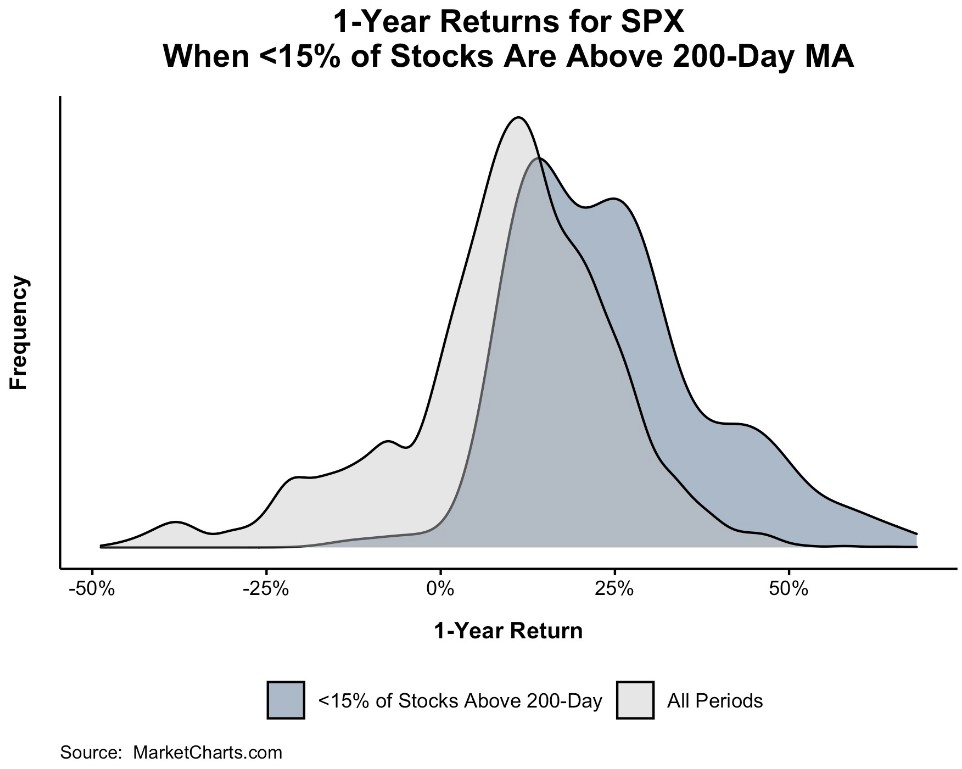

Last week, less than 85% [sic] of stocks in the S&P 500 were above their 200-day moving average. This has happened 219 times since 1987, with most of these periods clustered together. 1987, 2002, 2008, etc. The only time returns weren’t positive one year later was September 2001 (-13%), and October 2008 (-6%). That’s it.

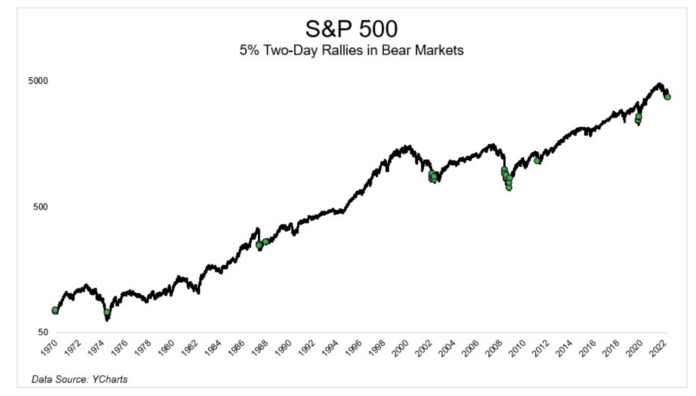

Stocks are currently in the midst of their best two-day return since April 2020. I wanted to take a look at all the 5% two-day returns while the S&P 500 was in a 20% drawdown and see if there was any signal there. It’s hardly a perfect track record. October 2008 for example was not the low, for example. But it’s not too shabby either. Historically these types of moves didn’t necessarily happen at the low, but around it.

I don’t know if that was the bottom. Maybe this is October 2008, or maybe this is March 2020. What I do know is that when the S&P 500 is down more than 25%, you buy it no questions asked.

You don’t need to catch the bottom. And you don’t need to get super aggressive in drawdowns either. Not everybody has the stomach for that. But you absolutely cannot under any circumstances sell after a major decline. You just can’t do it.

I wrote a whole book about Big Mistakes. The Warren Buffett’s and Stan Druckenmiller’s of the world can come back from them. For us mere mortals who aren’t trying to be masters of the financial universe, we must avoid them at all costs. The market is unforgiving and doesn’t often give second chances.

Stay in the game. Be patient. Avoid the big mistake. Do these things and you’ll be just fine.