$9,133 is up 30.5% in 9 months!

That is way up from just $6,221 in our last review and, of course, we added $1,400 more to equal $7,000 invested (including this month’s addition) but the other $2,133 is PROFIT! Congratulation to all who played along at home in months 1, 2, 3, 4, 5, 6, 7, 8 and 9 and don’t worry if you missed it – we are doing this for another 350 months and intend to make at least $990,867 more by the time we are done.

Our goal in this portfolio is to show our Members how to use slow, steady, simple options strategies to amass over $1M over 30 years by investing just $700/month ($252,000). If you can apply this discipline in your early working years – your retirement will be a breeze.

Our goal is to make at least 10% a year on our investments and, though it has only been 9 months – the portfolio is already up 30.5%. That’s a pace of 36.6% per year and, if we did that for 30 years, we’d have $99,525,167.84. No, I’m not kidding, you can do the math right here! It’s ridiculously unlikely we’ll keep up this pace, of course, but as long as we’re over 10% – we’ll be fine – and this is an excellent start! We will have ups and downs along the way and this portfolio doesn’t attempt to time the market, in fact, we were way off pace a couple of months ago but the recent rally has been perfect for us.

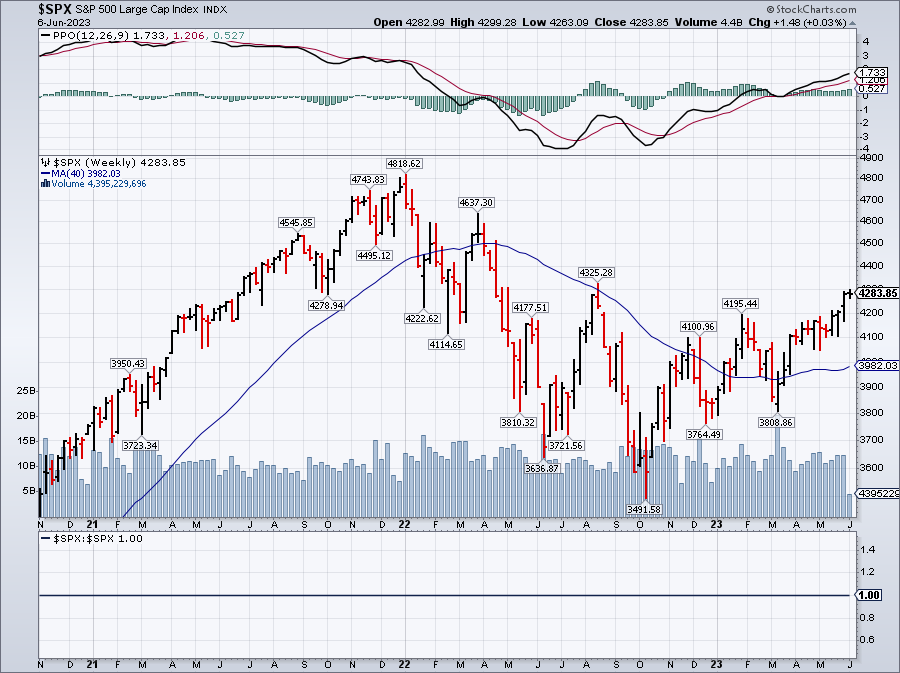

When we started the portfolio (Aug 25th), the S&P 500 was at 4,000 and now we’re at 4,300, up 7.5%. Due to the leverage we have in our positions, we made 30.5%. That’s the magic of using options and our Be the House – NOT the Gambler strategy, even when you play very conservatively, you can still beat the market by a wide margin.

As with all our PSW portfolios, the returns tend to accelerate as our positions mature and we are still ahead of expectations, which is very nice in a no-margin portfolio.

Of course you could play this portfolio with $7,000/month or $70,000 a month – the point is to learn how to build a portfolio from scratch and adjust over time – something we are just beginning to do with our 5 other, brand new, Member Portfolios as well. The key to building a good portfolio over time is CONSTANT VIGILANCE – that’s why we do these monthly reviews:

With our additional $700 deposit this month, we have $1,320 in buying power available and the first thing we do is review our current positions to see if they need adjusting.

-

- CIM – If we’re going to own a REIT, this is the one so we’ve obligated ourselves to buy 200 shares at $5 ($1,000) but we got paid $320 to make that promise by selling the puts so net $680 is our risk of ownership for 200 shares ($3.40/share). CIM currently pays 0.92/share in dividends so we’d be making 27% dividends if we were to be assigned so PLEASE – let that happen! We have $285 left to gain otherwise if, sadly the stock stays over $5.

-

- NYCB – Off to a good start at net $1,185 on the $1,800 spread so we are up $471 (65.9%) from our original $714 entry in April and we have $615 (51.9%) left to gain and we’re already over our $10 goal.

-

- SPWR – Cheaper than were we started at the moment and SPWR is our Stock of the Decade so it smells like an opportunity to me. In our Member Portfolios, we’d be selling 2025 $10 puts for $2.50 like they were going out of style for a net $7.50 entry but we don’t have margin here and it costs us $750 in buying power for each $250 we collect and that’s “only” a 33% return over 18 months – we can probably do better.

- The spread itself is net $3.11 and it’s $1.12 in the money. I would be surprised if we don’t hit $20 so the potential gain at $20 is $6.89 (221%) so tempting to add 2 more spreads here. As it stands, we have $4,945 (318%) left to gain at $23 on the net $1,555 spread.

-

- UNG – This is the Natural Gas ETF and we think /NG is way too low at $2.33 and it was even lower when we bought this. We’re halfway to goal and the $900 spread is currently net $345 so there’s $555 (160%) left to gain at $8.

-

- SOFI – My favorite sort of Bank. We were super-aggressive here and it’s paid off in spades already! Now comes the hard part because we have to decide if we are being greedy so I’m going to teach you a trick for planning ahead:

-

- I think $15 would be ideal for us but it’s not likely to get there smoothly.

- The 2025 $15 calls are $1 and have a Delta of 0.33

- The Jan 2024 $7.50 calls are $1.65 and have a delta of 0.63 so they’ll gain twice as fast on the way up – but they will also lose twice as fast on the way down.

- That means we can sell 3 of the 2024 $7.50 calls for $1.65 ($495) and, if SOFI goes higher, we will roll them to 2x or 3x of the 2025 $15 calls (if 3x we’d need to buy 2 more longs) and, if SOFI goes down, we keep the $495, which is enough to spend 0.70 per long rolling to a lower or longer-dated strike.

-

- And that is an excellent hedge! As our longs are $3, at $15, 7 of them would be worth $8,400 and currently we’re at net $3,513 so there’s $4,887 (239%) left to gain and we have now hedged $495 of our $1,438 in gains to date. Now you see why SOFI was our 2nd month’s play!

- Also the 1 SOFI 2025 $5 put is already up 50% with 18 months to go and we’re tying up $500 in buying power to make $92 (18.4%) more so we’re better off spending $92 to buy it back and reclaim net $408 in buying power.

So we added ($495-$92=) $403 to our buying power by selling those short calls, along with the $500 of buying power we released in buying back the puts – which means we now have a whopping $2,223 worth of buying power to deploy!

Our potential gains on the above positions are $11,287, which is 123.5% of the portfolio’s current value over the next 18 months – so we’re in pretty good shape.

At the moment, we would kind of like to add to SPWR but here’s the other candidates we’ve been looking at:

From our Watch List, we have BBAR, BCS, BIG, BGFV, BXMT, F, FF, IVZ, JETS, JWN, LABU, LEVI, OMI, PARA, PBR, TRVG, TWO and VALE as potential fits for this portfolio. BBAR was in the running with UNG and NYCB in month 8 and did not make the final cut but it’s taking off now.

Other potential stocks we discussed in Month 7 were (I left the March numbers so we can see how they’ve gone):

- B2 Gold Corp (BTG) is a gold producer with a 5% dividend at $3.58, which is $3.8Bn and they make $350M so p/e about 11. They also have $600M in the bank and we like gold as a hedge.

- Nokia (NOK) is still alive and more of an equipment service provider these days. $4.68 is $26Bn and they make about $2.5Bn so 10x but just a 1.79% dividend. They do have $4Bn in cash though – I like that!

- Global Ship Lease (GSL) is a container ship leasing company who are paying a 7.3% dividend against their $20.70 stock ($751M cap) but they made $274M last year and expect to grow about 20% this year – so a nice little company.

- Barclays (BCS) is from our Watch List at $8.32, which is $32.5Bn but they make $5Bn so 6x is stupidly low. They pay 4.1% and actually have $16Bn laying around on top of that – half of their market cap!

- Ford (F) is back in consideration at $12.56, which is $50Bn and they made $6Bn last year and should bump 10% this year. I’m pretty sure, 30 years from now, you’d be kicking yourself for not buying this one. Dividend is a nice 5% too. $95Bn in debt is the dark cloud but autos, inventory, etc. – it’s kind of normal.

- Future Fuel (FF) is one of my favorite small caps. $8.67 is $380M and they made $23M so 16.5x with a 2.5% dividend but then they paid a special 0.30 (3.4%) dividend in December – a nice bonus. They also have $185M in cash – half the valuation.

- Petrobas (PBR) – Would be great but the Government forces them to essentially give oil away to Brazilians. Even now, they are trying to sell assets and the Government is interfering. In a riskier portfolio, I don’t mind but not here.

- Tronox (TROX) – Specialty materials are always fun and sales are up to $3.2Bn from $1.8Bn in 2018 and profits are $220M but $16.42 is $2.5Bn so call it 12x. 3% dividend as well.

- Trivago (TRVG) – Travel is picking back up and $1.76 is $600M and they expect to make $60M this year so 10X is underpriced. No dividends but fun options.

Now that we’ve had a chance to see Q1 earnings from this group (and read 3 months worth of news stories and observed the macros), we can go back over our candidates (SPWR was also one at the time) and see who is the best fit. We also take into account what sectors we already have and, of course, whether or not we’ll get good bang for our buck using options.

TRVG strikes me right away as an interesting play as $1.18 is $404M and they are on track to make $50M this year, which puts them around 8x earnings. Unfortunately, they only have short-term (Jan 2024), thinly-traded options so we’d have to buy the stock and we can’t hedge it – that’s a shame.

I’d hate to see Ford (F) get away, Tronox (TROX) I love as a manufacturing play… (I am narrating my thoughts as I look over the list) – ahha! Future Fuel (FF) for some reason never gets any respect but $8.73 is $382M but they have $180M in CASH net of debt so it’s more like net $202M in market cap and they just made 0.48 per share for Q1 and paid an 0.06 dividend on May 31st – what’s not to like?

Unfortunately, FF is even worse than TRVG for options – they only go out until November but at least they trade actively. Since we are flush with cash, let’s try this:

-

- Buy 100 shares of FF for $8.79 ($879)

- Sell 1 Nov $7.50 call for $2 ($200)

That puts us in 100 shares at net $679, which is $6.79 per share, which is a 22.7% discount to the current price. If FF is over $7.50 (if it falls less than $1.29 or 14.6%), we get called away with a $71 profit (10.4%) in less than 6 months. At that point we may roll the calls to a higher strike or buy more longs or even sell puts – we’ll see what happens.

There goes $679 in buying power. If we had a margin account of any kind, we’d only be using half as much buying power and this would be an incredible 40% annualized trade! We still have $1,544 left to spend so let’s keep shopping:

Since we’re doing well, I want to make a speculative play on BBAR, which is a bank in Argentina. No one wants to invest in Argentina, where inflation is at 108.8% but that means the bank is charging over 100% interest on loans – you’ve got to love that (and with leveraged reserves!). The bank has a strong balance sheet and, if the currency stabilizes, they will make a fortune so let’s take as stab at them with the following:

-

- Buy 5 BBAR Jan $5 calls for $1 ($500)

- Sell 3 BBAR October $5 calls for 0.85 ($255)

Here we are spending just net $245 – so that’s the most we can lose but, if BBAR goes lower, we can sell more calls to cut the losses down further. If BBAR goes up, we have 2 uncovered calls so, most likely, we can roll the short October calls to a higher strike. The Jan $6 calls are 0.60 and that would leave us in a $500 spread with $255 (104%) upside potential in just 8 months.

We still have $1,299 in buying power so let’s show you another Stupid Options Trick you can use in a small portfolio: IVZ is very undervalued at the moment but the sector is uncertain so let’s try the following:

-

- Buy 5 IVZ 2025 $17 calls for $1.90 ($950)

- Sell 3 IVZ October $15 calls for $1.80 ($540)

Here we are only using net $410 in cash and we will be charged $600 in margin for the 3 calls that are not covered for $2 of potential gains but the reality is we bought $950 of 590-day premium ($1.61/day) and we sold (IVZ is $16), $240 of 135-day premium ($1.77/day). So we’re covering our own premium decay and the 2025 $20 calls are $1.05, which would be $525 for $5 so that’s our anticipated even roll.

So, either IVZ is flat or down and we sell more calls to reduce our net or IVZ goes up and we execute the roll (freeing up the margin) and then we’re in the $17/20 spread ($1,500) for net $430ish with $1,000(ish) (232%) upside potential.

That leaves us with $289 in buying power and we started with $1,320 so we’ve used $1,031 today and added $1,326 in upside potential but some of that was short-term so I’m very happy with where we are at the moment with $12,613 (138%) upside potential ahead of us in the next 18 months.

This is how we build a high-performance portfolio: Position by position, review by review, month by month, quarter by quarter, year after year. If you have a portfolio and you don’t know how much money every position is supposed to make and over what period of time so you can constantly monitor their progress – you’re doing it wrong!

If this all seems a bit boring – you’re doing it right!