Ugly home sales data and a dismal dip back into contraction for Texas manufacturing production continued the trend of disappointing macro data…

Source: Bloomberg

Black Friday was ‘mixed’ according to reports.

No one really knows how the American consumer did over the weekend – choose your own adventure:

-

HOT – Black Friday e-commerce spending popped 7.5% from a year earlier, reaching a record $9.8 billion in the U.S., according to an Adobe Analytics report.

-

COLD – Morgan Stanley analyst Alex Straton’s Black Friday store checks pointed to ~flat to down Y/Y traffic across Softlines Retail/Brands. Goldman Sachs analyst Kate McShane visited various retailers on Black Friday, noting that overall traffic still appeared muted relative to 2019 at most “traditional” Black Friday weekend destinations

-

JUST RIGHT? – Mastercard Spendingpulse said on Saturday that U.S. retail sales on Black Friday rose 2.5% year-over-year

Mickey Drexler summed it all up best: Black Friday is a “race to the bottom,” that trains consumers to always expect discounts – significantly cutting into retailers’ margins

One look at bonds today suggests that Morgan Stanley and Goldman Sachs may be on to something as yields tumbled (with the long-end outperforming today: 30Y -7bps, 2Y -4bps), erasing much of Friday’s thin liquidity rise in yields…

Source: Bloomberg

Nasdaq outperformed on the day but none of the majors were able to hold gains from the 1300ET close on Friday. Small Caps were the biggest loser…

VIX ended higher on the day with a 12-handle close for the 2nd day in a row…

Homebuilders dumped on the ugly housing data reality-check. But, of course, the BTFD crowd stepped in because rates were falling…

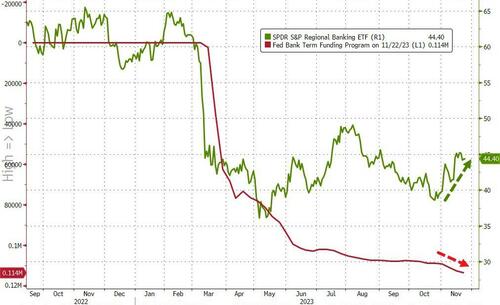

Bank stocks were sold today…

…perhaps as reality hits about the sudden recent re-accleration in demand for funds from The Fed’s emergency bank bailout plan…

Source: Bloomberg

The dollar extended its recent trend lower…

Source: Bloomberg

And as the dollar dropped, spot gold prices accelerated higher, breaking back above $2000 to its highest since May…

Source: Bloomberg

Oil prices trod water today with WTI hovering around $75…

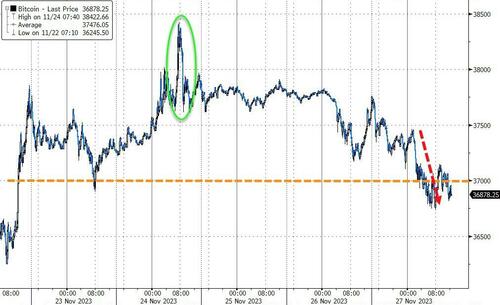

Gold’s gain was crypto’s loss today as Bitcoin slipped back to $37,000

Source: Bloomberg

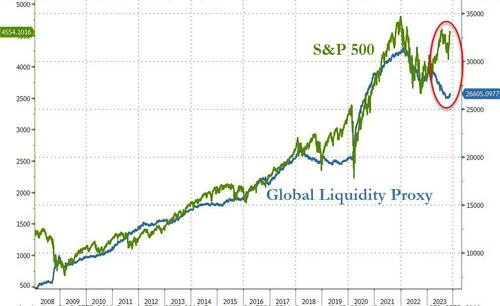

Finally, financial conditions continue to loosen dramatically…

Will Powell use his speech this week to walk back this dovish overhang and re-engage the ‘FCI Loop’?

Global liquidity suggests S&P’s fair value is “lower”…

Source: Bloomberg

Which will it hit first – 5,000 or 3,600?