What a crazy year 2015 was!

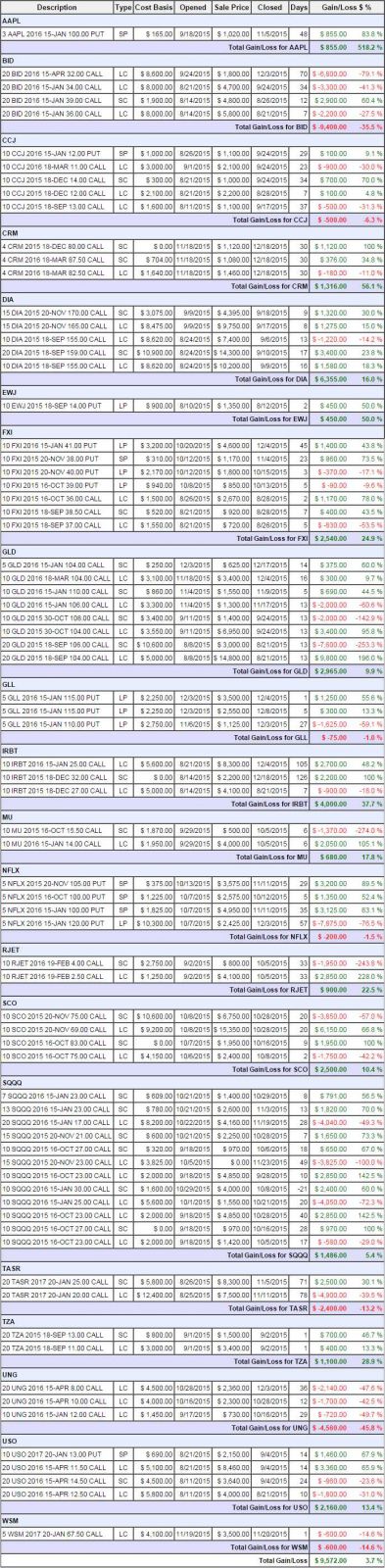

We began tracking this new virtual portfolio back in August and, in less than 4 months, we closed 80 option positions on 20 stocks (or ETFs) so pretty active in the beginning. At one point we were up 20% but the net gain on the positions we've closed ended up at just $9,572 or +9.5% from our $100,000 opening balance.

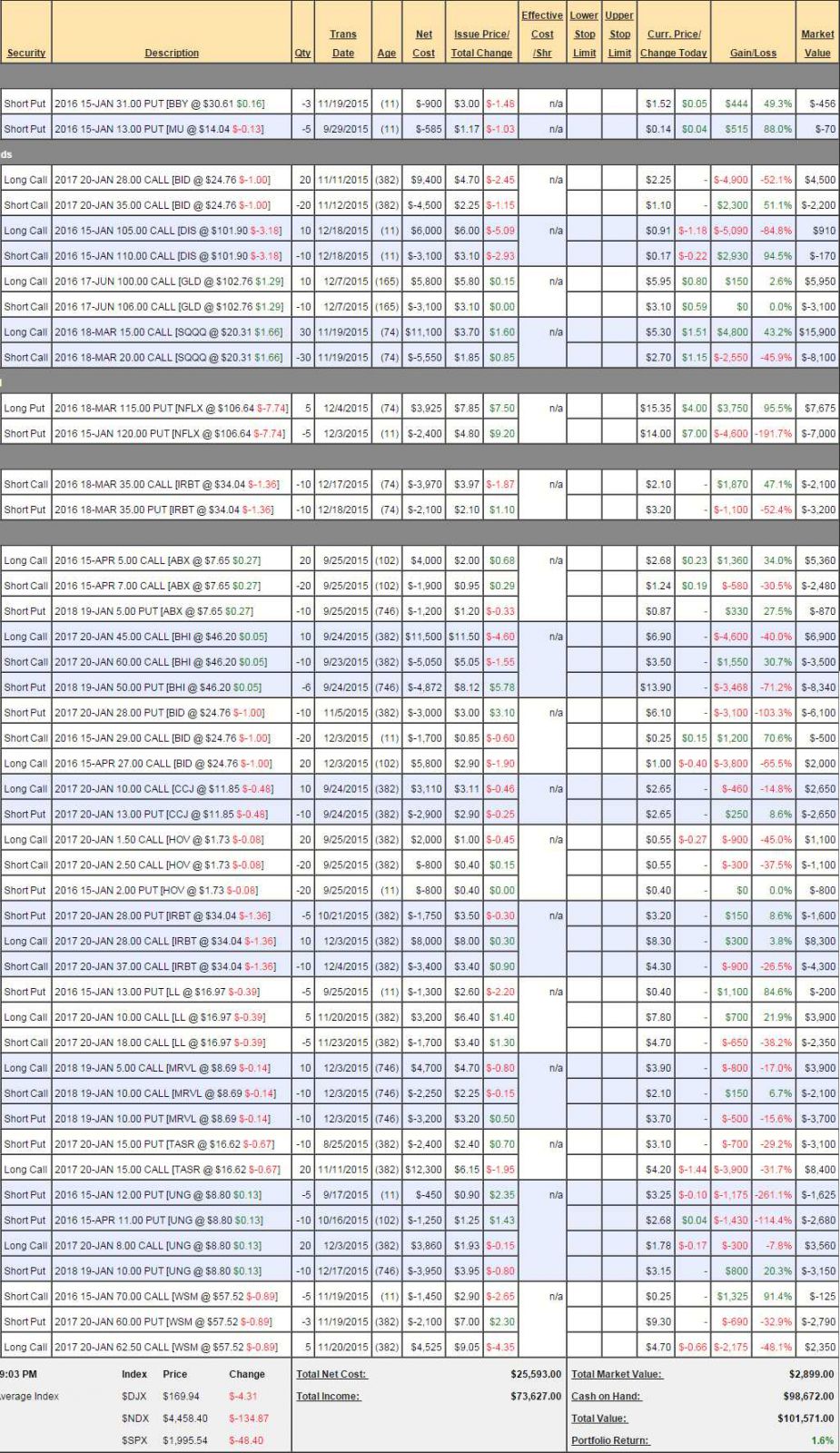

Since that pace was more hectic than we had intended and the market was very choppy, we moved towards longer-term investments which have the downside of being "expensive" to set up - in that the portfolio will tend to reflect the worst-case scenario for buying or selling options based on the bid/ask spread - no matter how unrealistic the pricing is. This is, however, something options players need to learn to understand when they are looking at their positions - and we'll discuss that in detail as we examine each of our open positions:

Notice first that we have $98,672 worth of cash on hand. We started with $100,000 and, using just $1,328 of our original cash, we now control a substantial amount of positions. On the margin side, we are using $48,700 out of $200,000 of ordinary margin (not Portfolio Margin, which would be much more) and, generally, we don't want to use more than 1/2 of our margin - saving the rest for emergencies.

At this stage in the process, we're not so much concerned with the BALANCE of the positions as we are to whether or not they are on or off track for their goals. Options trades can swing wildly in value as premiums fluctuate as well as the price of the underlying security - your job as an options trader is to understand the VALUE of your options so you can identify which ones are misPRICED and learn to take advantage of the differences.