DARK HORSE HEDGE UPDATE

By Scott at Sabrient and Ilene of PSW

You can run, you can run, tell my friend-boy, Willie Brown.

You can run, tell my friend-boy, Willie Brown.

Lord, that I’m standin’ at the crossroad, babe,

I believe I’m sinking down.– Crossroads, Robert Johnson

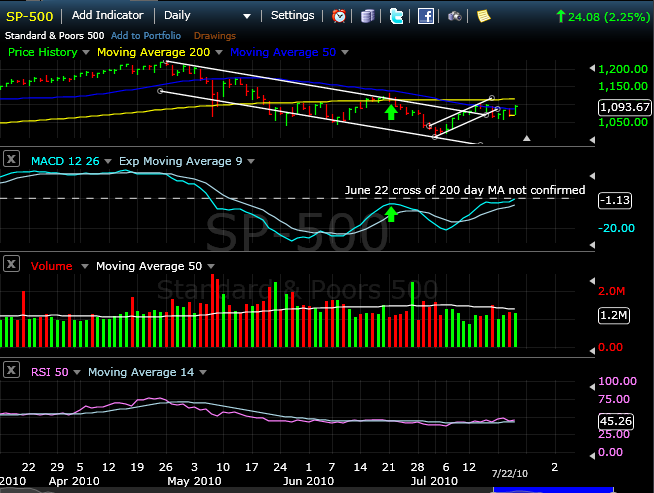

Heading into Friday July 23, 2010 the market is again at a technical crossroad with the SPX closing Thursday at 1093.7, above the 50-day Moving Average of 1085.5. The MACD 12-26-9 remains close but still under the (zero) signal line at -1.13, with the RSI 14-day at 45.26. There is lateral resistance at the 1096 level from the close last Thursday showing how the market has traveled a long way the past week to get nowhere.

Amazon.com Inc. (AMZN) fell short of analysts’ forecasts after Thursday’s close and was down 14% in after-hours trading, suggesting that the market may follow the pattern it has been in most of the summer.

Up 200, down 200, up 200, down 200 – wash out your savings, rinse and repeat! What a total sham of a market we have these days with machines running us up and down on virtually no news at all. Yesterday they would have you believe that Ben Bernanke caused a sell-off. How ridiculous is that? He didn’t say one thing that he didn’t already say in the Fed Minutes that were released on the 14th, which were the notes from the meeting of June 23rd so for analysts to get on TV and say “the markets were concerned by the Chairman’s comments” is beyond stupid – it’s criminal negligence. Phil’s Thrill-Ride Thursday.

[chart from freestockchart.com]

Thursday’s economic releases were less than encouraging with a jump in the number of people seeking unemployment benefits. Sales of previously owned homes fell, but the market shrugged it off as seasonal and rallied on the earnings of Caterpillar Inc., UPS Inc., and others that beat estimates. However, the SPX hasn’t been able to break through resistance at 1096 and essentially has gone nowhere since last Thursday.

SHORT TEX–maintain short position opened on Monday July 19, 2010.

DHH entered into a swing trade on TEX on Monday looking for another quarterly disappointment. The company announced late Wednesday a loss from continuing operations for the second quarter of $13.1 million or -$.12 per share. The analysts’ forecast was for a loss of -$.30 per share and the stock has rallied somewhat on that news. Other sources are reporting the actual comparable loss for the second quarter 2010 is -$.39. Terex Corp’s operating cash flow has been -$300 million cash for the last 12 months. For this and other reasons we believe it is reasonable to maintain the SHORT position in TEX and so it becomes the seventh SHORT in the DHH portfolio.

SHORT BOOM at open on Friday July 23, 2010.

As we continue to move toward getting a fully invested portfolio we are adding a SHORT on Dynamic Materials Corp. (BOOM). The company announces their 2nd quarter performance on July 29. Six analysts following BOOM are forecasting a breakeven quarter with a low estimate of -$.02 to a high estimate of +$.03. With a P/E of 51.45 we feel BOOM is overvalued at these prices and is suseptible to any market downturn. Sabrient has a STRONGSELL on BOOM, with it scoring well below industry averages on GROWTH, VALUE, EARNINGS and EARNINGS MOMENTUM.

LONG GME at Open Friday July 23, 2010.

We like Gamestop Corp. (GME) at these prices. GME is trading at a P/E of 7.5, versus the industry average of 13.8, allowing plenty of room to move higher just by continuing to perform. 18 analysts cover GME and forecast +$.25 to +$.28 for the 2nd quarter and around +$.39 in the 3rd quarter. GME beat forecasts the previous three quarters. Sabrient has a STRONGBUY on the stock with a VALUE score of 97 out of 100. We believe GME is trading at VALUE prices in this market.

These additions bring the DHH portfolio to eight SHORT and four LONG positions (see previous positions below). We will continue to monitor the market and advise you of changes in our tilting, if and when we make changes. Friday will be an important test for the bulls as the market is at the top of its trading channel. The preponderance of evidence points towards a decline on Friday but we are positioned well in either case. If the bulls win out and the market can break through resistance we will issue LONG openings for Monday to go BALANCED in the virtual portfolio.

Follow along with the building of the Dark Horse Hedge portfolio, which began at the beginning of July here.>

DARK HORSE HEDGE’s portfolio and new short for 7/19/2010

By Scott at Sabrient and Ilene of PSW

SHORT Terex Corp. (TEX) at the Open Monday 7/19.

Previously initiated positions (click on the ticker for Sabrient’s report).

Longs (opening prices):

Western Digital Corp., WDC long at $31.90 on July 13

Xyratex Ltd, XRTX, long at $14.64 on July 1

Telecom Argentina S.A., TEO, long at $16.38 on July 1

Shorts (opening prices):

Apartment Investment and Management Co., AIV, short at $20.73 on July 13

Sun Trust Bank, STI, short at $25.54 on July 13

The St. Joe Company, JOE, short at $23.74 on July 1

USG Corporation, USG, short at $12.08 on July 1

Houston American Energy Corp, HUSA, short at $9.91 on July 1

AMAG Pharmaceuticals, Inc., AMAG, short at $34. 38 on July 1

*****

Follow the DHH’s market thoughts and new buys and sells here.

Stock selection by Scott using Sabrient‘s analytical tools. Read more about Sabrient’s newsletters here.>

Authors have no positions in the above-mentioned stocks.