Isn't this exciting!

Isn't this exciting!

The pre-markets are up 1% after a long weekend. That hasn't happened since – two weeks ago! Of course last Tuesday, we were jammed up as well and the Tuesday after Christmas, we were jammed up as well but THIS TIME – we're REALLY feeling it, right?

The funniest thing is the way they have dozens of idiots saying all sorts of ridiculous things on CNBC and not one of them mentions even the vaguest hint of deja vu in what has been the most consistent pattern of late 2011, early 2012.

On this Dollar chart from Scott Pluschau, you can see the dives that are occasionally taken to goose the markets and we have another one this morning with the Dollar down 1%, making the 1% pop in the futures slightly less impressive when taken in context.

This time may be different because, according to Friday's Legacy Commitments of Traders Report released by the CTFC, Commercial Traders are now net short on the Dollar to the tune of 59,023 to just 6,061 longs – about a 10:1 ratio that is EXTREME to say the least. Non-Reportable, Non-Commercial Traders (ie. Speculators), on the other hand, are almost 10:1 the other way with 9,765 long contracts and just 1,390 shorts. Reportable Non-Commercial Traders (Hedge Funds) fill out the rest of the longs with 52,644 long contracts against just 8,057 shorts.

That's an odd sort of positions for the speculating class to be taking (super-long on the Dollar) considering the possibility of a highly dilutive quantitative event (QE3) in the very near future. This is why we can't be gung-ho bearish – tempting though it may be and this is why every little rumor of Europe being "fixed" sends the Dollar flying down – there are no buyers – only nervous long Dollar holders.

As you can see from the chart above, it's not unreasonable to look at the Global situation and assume the Dollar can get much stronger as it can still gain 50% and not be back to 2002 highs. Of course, as we know, the 20% run in the Dollar from early 2000 to 2002 is the reason "partying like it's 1999" has a negative connotation for stock traders and, at 81, a 20% run in the Dollar only gets us back to 97.20 – not "strong" by any measure.

As you can see from the chart above, it's not unreasonable to look at the Global situation and assume the Dollar can get much stronger as it can still gain 50% and not be back to 2002 highs. Of course, as we know, the 20% run in the Dollar from early 2000 to 2002 is the reason "partying like it's 1999" has a negative connotation for stock traders and, at 81, a 20% run in the Dollar only gets us back to 97.20 – not "strong" by any measure.

The commodity pushers want the Dollar as low as possible (so they get more of them) and our stocks are also priced in Dollars so our Corporate Masters also like a weak Dollar as it pumps up their balance sheets and makes them look clever as they make more money for selling the same or even less stuff as our own Federal Reserve take inflation denial to new heights with each glowing report on our economy.

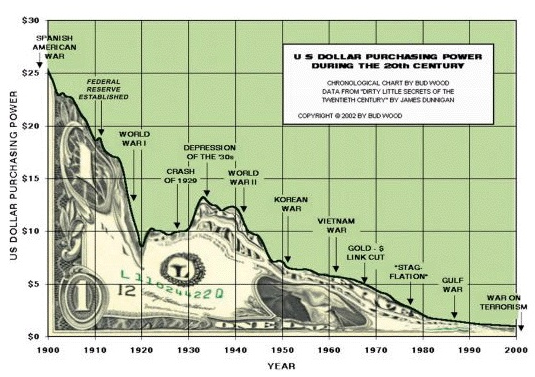

Yet you fall for it EVERY TIME – it's amazing really. If investors were rats, they would be shipped back from the behavioral laboratory to the rat farm as "defective" – unable to learn even the simplest of mazes as they head down the wrong path over and over and over again. It's not your fault though – this is a pattern that's been going on for over 100 years as America's "dirty little secret" has always been currency debasement as a secret tax on it's working citizens (ie. the bottom 99%):

At what point on this chart would it have made sense to lend the United States money for 30 years at 3% interest? THAT's why we had a very bad bond auction last Thursday as Global Lenders have their own problems and, without a strengthening Dollar, they have no reason to risk their relatively sound currencies to fund our continuing deficits. If not for Europe LOOKING even worse than we do at the moment – the Dollar would be at new all-time lows. Just take a look at the damage that's been done to the economy in the Great Recession:

Here we are with many stocks and commodities right back at 2007 levels – as if we haven't skipped a beat. Does something seem wrong with this picture? If so, you are what they used to call "rational" but are now called a "nattering nabob of negatavism" – a term first used by Spiro Agnew (written for him by the great William Safire) to dismiss the various crimes and economic catastrophe of the Nixon Administration and recently brought back by Phil Gramm, who's economic strategy for John McCain was to tell the American people to "suck it up" and "stop whining" about the Bush economy.

It's always good to label your enemies with alliteration – it makes you seem smart and gives them a label that sticks in people's minds and, as we know from the Smashing Pumpkins:

The world is a vampire, sent to drain

Secret destroyers, hold you up to the flames

And what do I get, for my pain?

Betrayed desires, and a piece of the gameDespite all my rage I am still just a rat in a cage

At PSW, we don't have to run through the maze 5 times before we know what lever to push! Like last Tuesday and the Tuesday before that and the Tuesday before that, we took the opportunity in early morning Member Chat to short the BS Futures rally and already (8:50), our Egg McMuffins are paid for as we got a nice little sell-off. We'll be happy to go bullish – truly we will – when there is ACTUAL EVIDENCE that indicates we should.

So far, we are NOT feeling it this morning with MTB missing by .49 (out of $1.53 expected) and C missing by .10 (out of .48 expected). CHKP beat by a bit, EDU had a slight miss, AMTD had a slight beat in earnings but missed revenues by a smidge, WFC was in-line, FRC small beat, MMR big beat and FRX had a small beat. Unfortunately, misses by two big banks trumps so-so results by the rest and should not support $14 on XLF today.

So far, we are NOT feeling it this morning with MTB missing by .49 (out of $1.53 expected) and C missing by .10 (out of .48 expected). CHKP beat by a bit, EDU had a slight miss, AMTD had a slight beat in earnings but missed revenues by a smidge, WFC was in-line, FRC small beat, MMR big beat and FRX had a small beat. Unfortunately, misses by two big banks trumps so-so results by the rest and should not support $14 on XLF today.

We have plenty more "real" evidence this week to gather with PNFP tonight, SCHW and GS tomorrow morning, FFIV and KMP Wednesday night, BAC, FCS, PGR and UNH Thursday morning followed by ED, PBCT and SWKS that night and Friday we hear from Poppa GE along with SLB adn STI and THAT will give us a pretty good picture of what really went on in Q4.

Unfortunately, that means we continue to play it close to the vest, using our cash to poke at a few opportunities and picking up some good deals (like RCL this morning on the dip) but generally for quick trades until we get a clearer picture of where things stand.

The FT pointed out this weekend that the ongoing Iran crisis is masking internal signs of Brent weakness – something we're also picking up in the above-mentioned Commitment Report. Backwardation is changing to contango in the oil contracts and that's often the sign of a correction coming (we are long SCO already) and, if Iran doesn't "come through" for the oil bulls and do something very crazy very soon – the serious lack of Global demand for crude combined with the record supplies that are now on-line are capable of leading to a very sharp correction (see "The Oil Hawks are Living in Cloud Cuckoo Land" – also from the FT this weekend).

Our position on oil has been very clear – over $100 we short it. At $101, we short it. At $102 (which we had early this morning), we short it. At $103.50 – we back up the truck and short it. Why? BECAUSE OIL IS NOT WORTH $100 A BARREL. I'm sorry, it's just not. Gold is also not worth $1,500 an ounce but that doesn't mean there aren't going to be idiots lining up to buy it.

Thank goodness for those idiots – they pay for all our Egg McMuffins!

Currency cartoon by Elaine Supkis, Culture of Life News.