What a crazy month we had!

What a crazy month we had!

The Dow began the month of October at 9,712 and finished the month of October at EXACTLY 9,712. Now I don't want to say the market is manipulated but… No, I've got nothing, there are no buts – the market is totally manipulated! Either that or you believe that the random outcome of tens of millions of traders around the globe trading hundreds of billions of shares of stock would just so happen to begin and end the month within .50 after going as low as 9,378.77 (on the 5th) and as high as 10,157.94 (on the 21st). So that is literally a 1 out of the 779-point swing coincidence to hit that 9,712 nail on the head.

At PSW we couldn't be happier about this frankly. As I often say to members: We don't care IF the game is rigged, as long as we can figure out HOW the game is rigged so we can play along. We were bearish in our September 27th Wrap-Up when I predicted that Earnings season would bring about a "Return to Fundamentals." We targeted retrace moves of Dow 9,512, S&P 1,020, Nasdaq 2,030, NYSE 9,496 and Russell 556 – all of which we hit the following Friday.

That week I highlighted my fundamental market concerns and Monday (9/28) my topic was "6 Unemployed People Per Available Job," Tuesday I said "Consumer Confidence is Key," Wednesday we caught the turn perfectly as I predicted "End of Quarter, End of Pump," and Thursday, October 1st was the day that "REIT's Turned Rotten" – which was something we had been playing for during the September rally so we were thrilled with what is NOW the 2nd worst down day of the month. That was the day GS decided to agree with me that REITs were over-valued and gave us a signal that the Gang of 12 were no longer all on the same page. Friday, the 2nd, we were back to looking at the Jobs numbers when I asked "Is Anybody Working for the Weekend."

We could not have been more pleased with what was the worst week in the market since then end of August, which was a,most as bad at the beginning of July (are you beginning to see a pattern?) and I said that Friday: "Just like any good roller coaster, market plunges can be fun when you are strapped in safely and prepared for them. Our members have been so prepared we’ll have to hand our Eagle Scout badges (we don’t need no stinkin’ badges) for riding out a toppy market for two tedious weeks, which I won’t rehash here but you can go back to my Sept 19th "Wrong Way Weekly Wrap-Up" to see how hard it was to stay bearish in the face of all that "great" news that the media kept throwing at us. Nonetheless, had you followed our trading ideas in that post, you’d be a VERY happy camper right now!"

See, there's no great trick to what we did THIS week, we just replayed the game plan from a month ago as we came to the tail-end of another pump and dump month. We had finally gotten low enough at the beginning of October that I was able to publish our first Watch List of bullish plays since our June 20th Long Shot Virtual Portfolio and our early July Buy/List (although we did also take advantage of the September dip with a Watch List on our $100K Virtual Portfolio). This is something a lot of people misunderstand about the way we play the market. We set up these very bullish plays, WHEN THERE IS A GOOD OPPORTUNITY and these plays have fantastic returns over time and the bearsish stances we often take in any given month are aimed at protecting our winners as we ride out the little market dips long-term.

See, there's no great trick to what we did THIS week, we just replayed the game plan from a month ago as we came to the tail-end of another pump and dump month. We had finally gotten low enough at the beginning of October that I was able to publish our first Watch List of bullish plays since our June 20th Long Shot Virtual Portfolio and our early July Buy/List (although we did also take advantage of the September dip with a Watch List on our $100K Virtual Portfolio). This is something a lot of people misunderstand about the way we play the market. We set up these very bullish plays, WHEN THERE IS A GOOD OPPORTUNITY and these plays have fantastic returns over time and the bearsish stances we often take in any given month are aimed at protecting our winners as we ride out the little market dips long-term.

On Thursday, the 8th, we were "through the roof" on our technicals and I pointed out in the morning post that the very quick turn-around in the market had left us way too bearish, which is why I had posted the new Watch List for members the night before. I said: "We’ll be looking for action that beats our best September closes of Dow 9,829, S&P 1,071, Nas 2,146, NYSE 7,047 and RUT 620 to confirm that this really is a new rally and not just the double top we’ve been thinking it was." In October, that watch list remained our bullish covers to what was a more generally bearish virtual portfolio.

I remained skeptical on the Weekly Wrap-Up of the 10th, where I asked if the markets were going "Double Up or Double Top?" After going 28 for 36 in our trade ideas for the first week of the month, we were forced to stop out our bearish trades that Monday (5th) as the market popped up on us and we did get caught a little flat-footed by the 400-point up week and, rather than buy bullish plays, which we didn't really believe in, we ended up short-selling a lot of calls. While this strategy ultimately prevailed – it was a rough ride as the market still had another 300-points of pop left in it. It wasn't wholly unexpected though as my cynical commentary of that Saturday was:

Again, way too many short picks and we went into the weekend still officially 55% bearish (using covers against open positions to even things out) but very nervous as we are both pushing up against our breakout levels AND in the top of the 5% rule range (indicating follow-through is likely) AND heading into a low-volume holiday trading day on Monday that I already said would likely be an up day. Why then, you may ask, are we still bearish? Well, as the great stock analyst Elaine once said, this whole "rally" just seemed fake, fake, fake, fake! We sure have plenty of bearish bets on the table but we also recognize the need to take up some aggressive bullish positions if our indexes give us another green day on Monday.

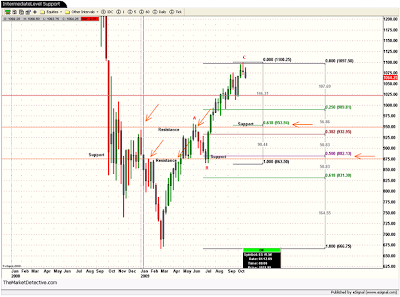

We did get an up day on Monday, the 12th but I had gone even more against the rally, even as we followed through with our buy picks on Monday as I warned that we were only covering as I discussed this being another market bubble caused by "The Inverted Risk Pyramid." Tuesday I asked if we were "Topping or Popping," reminding members: "We remain skeptical but you can be skeptical and still make money, as you can see from Corey’s (Afraid to Trade) very nice S&P Chart, you can do very well in this market buying the dips OR selling the tops – we kind of like to do both." I had a great football analogy in that post, where I warned the bears that it was futile to keep betting against a market move that was clearly going against you.

We did get an up day on Monday, the 12th but I had gone even more against the rally, even as we followed through with our buy picks on Monday as I warned that we were only covering as I discussed this being another market bubble caused by "The Inverted Risk Pyramid." Tuesday I asked if we were "Topping or Popping," reminding members: "We remain skeptical but you can be skeptical and still make money, as you can see from Corey’s (Afraid to Trade) very nice S&P Chart, you can do very well in this market buying the dips OR selling the tops – we kind of like to do both." I had a great football analogy in that post, where I warned the bears that it was futile to keep betting against a market move that was clearly going against you.

That Wednesday (14th) we got a huge market move from INTC and JPM's very positive earnings reports. My commentary in that morning's post was: "The levels we’ve been watching (Dow 9,829, S&P 1,071, Nas 2,146, NYSE 7,047 and Russell 620), should be crushed this morning and, hopefully, will hold up through the end of day. If this is a real rally then we should have no trouble and the last thing the bulls want to see is volume selling at this level, which we are still slightly concerned about." We flew up that day but I didn't like the WAY we went up and, in Member Chat, my commentary on the situation was:

I do wish we were more bullish, this is a very smart group of people and we’re pretty bearish but so is the general investing public or there’d be volume to this rally. I have a hard time ignoring the fact that 600,000 more people lost their jobs this week and, even if it’s "only" 500,000, I still think that’s not really a sign of a healty economy. I think the REITs are off in fantasy land and I think so is the government, who cannot keep borrowing money at these low rates. The dollar has dropped 25% of it’s value since March so the market is only 25% ahead of the currency fall which means a flight back to the dollar, which could happen very suddenly if an EU nation like Spain collapses, could send our market down as fast a 9/11.

That being said, we have no choice but to follow the technicals and now that we can look at nice, easy support levels like Dow 10,000, S&P 1,100, NYSE 7.200, Nas, 2,200 and RUT 620 and simply call that the mark at which we’re 60% bullish. I’ve given some thought to what kind of protection we should use in a market like this and I’m thinking of taking some higher-percentage payers for protection as the higher we go, the more likely we have a scary correction as some point but, on the other hand, we want to try to minimize our capital at risk on the short side because once we’re over these levels, there’s no reason we can’t just go up another 20% because Dow 12,000 is no stupider than Dow 10,000 – we’ve already maxed out the stupid meter and the next stop is panic buying by the herd.

How’s that for a bullish sentiment?

I was REALLY trying to ignore the fundamentals and get more bullish but, that Friday (16th), in the morning post I was forced to say "Every time I try to get bullish, they pull me back in!" as I just couldn't see the Industrial Production Report as a sustainable positive saying:

I was REALLY trying to ignore the fundamentals and get more bullish but, that Friday (16th), in the morning post I was forced to say "Every time I try to get bullish, they pull me back in!" as I just couldn't see the Industrial Production Report as a sustainable positive saying:

"We’ve been saying for quite some time that revenue projections are in fantasy land. Overall wages may be up 0.2% for the year but the average workweek is down 7% and 10% of our population isn’t taking home a paycheck at all – of course revenues are going to be down, how is that even surprising? For the week, revenues of reporting companies are down about 18% so I consider a winner anyone who’s ahead of the curve (not counting financials, who were given special gifts this year). Even with that gift, it was the financial unit that dragged GE down, with GE Capital’s profits down 87% for the quarter, dragging corporate earnings down to just 23 cents a share, but better than the .20 expected by analysts (see my weekend rant against low expectations)."

I called that Weekly Wrap-Up "10,000 or Bust!" as that was what I felt we faced the next week with a failure to hold 10,000 looking like a major failure in the "rally." I reiterated a list of stocks I thought were clearly overvalued and you could have had a fabulous last 2 weeks of October just shorting my October 17th list of AMZN, BIDU, AM, PALM, NFLX, PCLN, URBN, UHS, CERN, CREE, GMCR, CY, SWM, TRLG and BKE. Other than AMZN, of course, which is the play that killed our $100K Virtual Portfolio for the month! We were in no way prepared for that short call to go so far against us and we are currently in rescue mode, having rolled up to the short sale of the Nov $110 calls, which squeezed us VERY HARD last week.

Monday, October 19th, we had big, market-boosting moves and statements from "Bernanke, Beijing and Britain" and, fortunately, we were prepared to go with the flow as we had set up bullish plays the previous week on SO, ERX, VZ, RIMM, BMY, EMC, AAPL, TXN and T but, as I mentioned in Tuesday morning's post, we couldn't help ourselves and took advantage of the pop to go bearish on WFMI, QLD, SPY, POT and bullish yet again on SRS at $9.50.

Monday, October 19th, we had big, market-boosting moves and statements from "Bernanke, Beijing and Britain" and, fortunately, we were prepared to go with the flow as we had set up bullish plays the previous week on SO, ERX, VZ, RIMM, BMY, EMC, AAPL, TXN and T but, as I mentioned in Tuesday morning's post, we couldn't help ourselves and took advantage of the pop to go bearish on WFMI, QLD, SPY, POT and bullish yet again on SRS at $9.50.

I reminded members that Tuesday that we were only bullish under duress and that we should be looking to cash out on the run up, pointing out on earnings that:

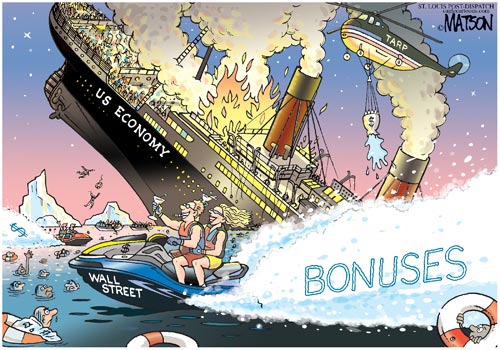

CAT is, of course, the poster child for the new measure of corporate success in America. They dramatically cut production and laid off thousands of workers and then benefited from Global stimulus, which boosted demand from developing countries such as China and Brazil, while a weaker dollar makes the company’s products less expensive in overseas markets and rising commodity prices boost that sector and keep their customers digging. Falling steel prices were also a huge help to CAT this year as the company also beat March expectations by 875% and June expectations by 227%, proving the theory that some analysts never learn.

Is this really and economic recovery? Declining dollars allowing foreign stimulus programs to afford more digging equipment for make-work programs while CAT slashes costs at home and shuts down long-term production… UTX had similar benefits while DD, KO and PFE all had huge benefits from the exchange rates so forgive me if I don’t run around screaming BUYBUYBUY despite all this "good" news.

So nothing too likely to end this party today, other than the sheer weight of the rally as we approach critical levels of Dow 10,200, S&P 1,100, Nasdaq 2,200, NYSE 7,250 and Russell 623. We don’t need those, we’re happy to stay more bullish as long as 3 of our 5 indexes are over Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623 but it sure would be nice to see the SOX over 338 and the Transports over 1,989 so we can get a little more aggressive on the long side. Until then, let’s be careful out there…

Wednesday, the 21st, was the straw that broke our bullish camel's back as we got the Beige Book results, which I reviewed in-depth for members that afternoon, concluding "I’m not at all sorry I was bearish all day but we’ll see if that lasts more than 12 hours." It did not last 12 hours and we got whipsawed the next day with a massive reversal all the way back to the month's highs!

Wednesday, the 21st, was the straw that broke our bullish camel's back as we got the Beige Book results, which I reviewed in-depth for members that afternoon, concluding "I’m not at all sorry I was bearish all day but we’ll see if that lasts more than 12 hours." It did not last 12 hours and we got whipsawed the next day with a massive reversal all the way back to the month's highs!

I was beyond skeptical last Thursday (22nd) and I went all fundamental again as we looked at what Max Keiser had to say about the question "Is the Crisis Over" where Max compares Wall Street bankers to suicide bombers and predicts it is only a matter of time before they are back before Congress with a gun to their heads threatening the destruction of America if they don’t get another bailout.

I had another round of short ideas in the morning post on "MS, IYT, CS, ICE, V, GMCR, DD, EBAY and even our beloved AAPL" and anyone taking those picks short would have done EXTREMELY well for themselves as only V has gone up against several significant moves down in that group. Of course, the members at PSW get the full trade ideas for options there and that turns those 3,5 and 10% winners into 30, 50 and 100% winners as we apply options leverage. FAZ, for example, where I did mention in the morning post we had shorted the $19 puts, saw a 15% improvement in the price of the stock since that mention while the puts we sold are up 55% and very likely to make us the full 100% as they were the $19 puts sold short at $1.80 (now .80).

I had another round of short ideas in the morning post on "MS, IYT, CS, ICE, V, GMCR, DD, EBAY and even our beloved AAPL" and anyone taking those picks short would have done EXTREMELY well for themselves as only V has gone up against several significant moves down in that group. Of course, the members at PSW get the full trade ideas for options there and that turns those 3,5 and 10% winners into 30, 50 and 100% winners as we apply options leverage. FAZ, for example, where I did mention in the morning post we had shorted the $19 puts, saw a 15% improvement in the price of the stock since that mention while the puts we sold are up 55% and very likely to make us the full 100% as they were the $19 puts sold short at $1.80 (now .80).

I commented that the Beige book had led me to conclude that "SRS was the way to go" for our bearish play, citing the following passage (as highlighted by me for Members) from the BBook: "The weakest sector was commercial real estate, with conditions described as either weak or deteriorating across all Districts. Banking also faltered in several Districts, with Kansas City and San Francisco noting continued erosion in credit quality (often with more expected in the future). One bright spot in the banking sector was lending to new homebuyers, in response to the first-time homebuyer tax credit. Finally, labor markets were typically characterized as weak or mixed, but with occasional pockets of improvement."

Despite the obvious play on SRS, we were still glad we had taken the money and ran on the bear side the day before. As I mentioned Thursday morning: "Of course we are not going to let all this negative data fool us into getting bearish again. Our plan (which worked already) was to make a quick 20% on our bearish plays and get the hell out as 20% is plenty to make on a day trade and you have to be disciplined in this market as almost no trend lasts past the close… Lots of data at 10 am and now we have to work hard just to get back to our "must hold" levels of: Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623, all of which were blown yesterday. Until we get back over 3 of 5 of those levels, we have little interest in new bullish plays."

We did have a nice spike down in the morning but I reminded Members in my 9:36 Alert: "Don’t forget to keep stops on those short plays – we got a huge break yesterday and there’s plenty of ways to play additional downside (like more SRS, SKF, FAZ…) so cash is a good thing." We were starting to like cash again as the dollar had pretty much fallen as far as we thought likely, at the 75 mark, and that was the only thing supporting the commodity bubble that was supporting the market bubble so we expected at least a small bounce in the dollar back to resistance at 76.5, which is what we got this week as Japan was forced to prop up the dollar to stop their own export economy from collapsing.

We did have a nice spike down in the morning but I reminded Members in my 9:36 Alert: "Don’t forget to keep stops on those short plays – we got a huge break yesterday and there’s plenty of ways to play additional downside (like more SRS, SKF, FAZ…) so cash is a good thing." We were starting to like cash again as the dollar had pretty much fallen as far as we thought likely, at the 75 mark, and that was the only thing supporting the commodity bubble that was supporting the market bubble so we expected at least a small bounce in the dollar back to resistance at 76.5, which is what we got this week as Japan was forced to prop up the dollar to stop their own export economy from collapsing.

By 2:51, the market had run up to 10,100 again but we didn't like the internals so I put up a "Bearish Buy List" for members:

- SRS Jan $11s for $1.05 (now $1.55, up 47%)

- SRS Apr $7s for $3.50 (covering on bounce with Apr $12s at $2+, now $1.50). (spread now $2.20)

- DIA $99 puts for $1.30 (now $3.20, up 146%)

- COF $38s sold for $1.90 (now $1.35, up 29%).

- FSLR $165 calls, sold naked for $6.20 (now .20, up 97%)

- MS $35 calls, sell naked at $1.50 (now .40, up 73%)

- AAPL $200 calls, sold short at $9 (now $1.96, up 78%)

- TZA $11 puts sold short for .75 (now .25, up 66%)

- TZA $11/12.50 bull call spread for .55 (now $1.15, up 52%)

- CAL Dec $13 puts sold for $1.10 (now $2.20, down 100%)

That last one serves me right for trying to offset with a bullish position but we do love CAL and have already scaled in and rolled that one to a better position. It only took a few market hours for us to begin seeing retruns on this set as I headlined last Friday's post (10/23) "Churn Baby, Churn!" as the bull trap sprang once again. As I pointed out in the morning post, we had set our upside targets for Thursday at Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623 and we finished at: Dow 1,081, S&P 1,092, Nasdaq 2,165, NYSE 7,182 and Russell 613. That was so impressive that I decided it was time for a commercial, which I'll repeat here:

That last one serves me right for trying to offset with a bullish position but we do love CAL and have already scaled in and rolled that one to a better position. It only took a few market hours for us to begin seeing retruns on this set as I headlined last Friday's post (10/23) "Churn Baby, Churn!" as the bull trap sprang once again. As I pointed out in the morning post, we had set our upside targets for Thursday at Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623 and we finished at: Dow 1,081, S&P 1,092, Nasdaq 2,165, NYSE 7,182 and Russell 613. That was so impressive that I decided it was time for a commercial, which I'll repeat here:

If knowing about massive market moves in advance would be helpful to you – please consider subscribing to our service. If you are already a member and know someone who might like to try our newsletter, you can send them a free trial subscription using this link and you can earn yourselves discounts on membership renewals for each friend who opts into the free trial. We have over 19,000 people on our Newsletter list now and I want to see if we can break 30,000 by the end of the year now that our new mail server is up and running (we’ve been on hold for a month as we filled up our old server!). Your help in this matter would be greatly appreciated. PSW Report Members can extend their subscriptions at no cost simply by referring others to a free trial report – my little experiment in viral marketing…

We had a big move up Friday morning on the AMZN and MSFT earnings but my 9:45 Alert to Members cautioned to hold the bearish line: "Breakout levels remain: Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623 and it’s a joke that we’re not taking them out on super-human news from AMZN and MSFT and nice words from Bernanke. Who is selling and what do they know? So I know you guys hate it when we get a blow out and I say do nothing but that’s my call for this morning. We are bearish enough on yesterday’s close." Despite AMZN's big pop, we decided to press our shorts in the $100KP and that was, unfortunately, a very painful adjustment. Of couse we still have a 3 weeks to see what happens for this expiration periot but it did leave us overexposed to the one position.

We had a big move up Friday morning on the AMZN and MSFT earnings but my 9:45 Alert to Members cautioned to hold the bearish line: "Breakout levels remain: Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623 and it’s a joke that we’re not taking them out on super-human news from AMZN and MSFT and nice words from Bernanke. Who is selling and what do they know? So I know you guys hate it when we get a blow out and I say do nothing but that’s my call for this morning. We are bearish enough on yesterday’s close." Despite AMZN's big pop, we decided to press our shorts in the $100KP and that was, unfortunately, a very painful adjustment. Of couse we still have a 3 weeks to see what happens for this expiration periot but it did leave us overexposed to the one position.

On Monday morning I asked the question: "Is Momentum Shifting?" as it seemed that the weight of the fundamentals was finally starting to drag on the bulls and those free "stick save" days were starting to lose their power as more and more volume came back into the market. I said in that morning post: "All we are asking of the markets is for them to take out our very simple levels and hold them for more than a day or two. Those levels are (and have been since early September): Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623," warning that, if we didn't, we were on our way back to Dow 9,650, S&P 1,020, Nas 2,075, NYSE 6,900 and Russell 575. Where DID we finish the week? Dow 9,712, S&P 1,036, Nas 2,045, NYSE 6,739 and Russell 562 – NOT GOOD!

Monday morning's rally began to fade under our targets around 11 and at 11:32 I said to members: "Nas has been frozen at 2,175 (43.50 on the Qs) but the Dow is weak in the knees for sure and, of course, the RUT is not impressing us. Oops, there it goes. Nice BS spike in AMZN right before failing – just confirms what manipulated BS it all is." Just one minute later, I decided we could add China to our short play list saying to members: "FXP at $8.09 (now $9.10, up 12%), $8 calls are .60 (now $1.35, up 108%) or Dec $8 puts can be sold for .75 (now .50, up 33%) – I like them all!"

Monday morning's rally began to fade under our targets around 11 and at 11:32 I said to members: "Nas has been frozen at 2,175 (43.50 on the Qs) but the Dow is weak in the knees for sure and, of course, the RUT is not impressing us. Oops, there it goes. Nice BS spike in AMZN right before failing – just confirms what manipulated BS it all is." Just one minute later, I decided we could add China to our short play list saying to members: "FXP at $8.09 (now $9.10, up 12%), $8 calls are .60 (now $1.35, up 108%) or Dec $8 puts can be sold for .75 (now .50, up 33%) – I like them all!"

We had our usual "Testy Tuesday Morning" where it was put up or shut up time for the Dow. Our freindbuddypal Jim Cramer had come out with bearish comments the night before – a very sudden turn around after herding his sheeple into the top of the market like a Japanese train stuffer for the first three weeks of the month.

I pointed out in that post why we were sticking out our fundamentally bearish position on AMZN, despite all technical evidence to the contrary as we focused our own level attention on NYSE 6,900, which I identified as the week's key indicator. In our morning alert I set up our 5% drop levels and 4% bounce levels and we nailed those during the week, sadly finishing below those 5% levels, which does not bode well for next week's open unless we get some form of government intervention. Consumer confidence fell that moring to 47.7 from 52.6, which was a catastrophic number and the Richmond Fed Index dropped in half, from 14 to 7 so I said to members in my 10:02 Alert: "Forget worrying about the upside, down we go!"

We pulled the cover off our long DIA puts and added XOM $70 puts at .77 (but averaged the entry at .65), which are now $1.30 (up 100%). We were in and out of DDM covers for a small loss as we bounced along resistance but after analyzing the bounce at 11:36 I said to members: "News of $5Bn IBM stock buyback is lifting the Dow (and everything else). IBM at $121.52, up 1.2% and adding 16 Dow points – keep that in mind. I think this may be a false rally. Watch that 9,920 line carefully. RUT is actually fading at 593 and NYSE not over 6,900 so don’t let the Dow distract you (XOM also moving up and, with CVX, adding 24 Dow points)." We pecked away at a few well-hedged long-term bullish plays but at 12:06 I said to members: "Noon volume is 92M but I think this is a top" and at 1:35, I said: "RUT blew 589 like paper – If you weren’t short before, get short now!"

We pulled the cover off our long DIA puts and added XOM $70 puts at .77 (but averaged the entry at .65), which are now $1.30 (up 100%). We were in and out of DDM covers for a small loss as we bounced along resistance but after analyzing the bounce at 11:36 I said to members: "News of $5Bn IBM stock buyback is lifting the Dow (and everything else). IBM at $121.52, up 1.2% and adding 16 Dow points – keep that in mind. I think this may be a false rally. Watch that 9,920 line carefully. RUT is actually fading at 593 and NYSE not over 6,900 so don’t let the Dow distract you (XOM also moving up and, with CVX, adding 24 Dow points)." We pecked away at a few well-hedged long-term bullish plays but at 12:06 I said to members: "Noon volume is 92M but I think this is a top" and at 1:35, I said: "RUT blew 589 like paper – If you weren’t short before, get short now!"

The NYSE BARELY held the 6,900 mark on Tuesday so it was "Will We Hold It Wednesday – NYSE 6,900 Edition" where I said the next critical line after NYSE 6,900 would be Russell 575 and that we would not be turning back bullish until we saw 600 retaken on that index. I restated that our 5% rule targets would be Dow 9,600, S&P 1,045, Nasdaq 2,066, NYSE 6,840 and Russell 589 and, of course, we blew all but the Dow that day and finished the week below all but the Dow as well. My morning outlook was:

"So we wait patiently for the GDP report and try to disengage our brains and stick to the technicals as it’s so tempting to bet the farm on the farm being foreclosed otherwise… Let’s be very careful out there, what we’re most worried about is what Pink Floyd called "a short, sharp shock" as some bit of data or earnings report can still send us flying off that cliff. We are not building a very exciting base here and all the big volume has been down. Until THAT trend breaks and we break back over our levels, it’s the down side of the moon for the markets."

"So we wait patiently for the GDP report and try to disengage our brains and stick to the technicals as it’s so tempting to bet the farm on the farm being foreclosed otherwise… Let’s be very careful out there, what we’re most worried about is what Pink Floyd called "a short, sharp shock" as some bit of data or earnings report can still send us flying off that cliff. We are not building a very exciting base here and all the big volume has been down. Until THAT trend breaks and we break back over our levels, it’s the down side of the moon for the markets."

We didn't play too much ahead of the GDP on Thursday. We had a very clever DDM/DXD spread that ended up paying off on both sides (as planned actually) in wild 200-point up and down swings we on each side of that report. We got more confident in our AMZN shorts and even tried to buy back our protective short puts and at 10:51 I said to Members: "The Dow is still delusionally leading the other indexes and they are going to snap hard if we start failing levels… Did I mention I like those DXDs?" My best call of the week was my warning to the bears that afternoon where I warned that we needed to look lock in our gains for the day as we fully expected at least a bounce off our 5% levels. Of course we were still surprised by how big that bounce was!

It was "GDPhursday – No Jobs for US!" and I asked whether 18M unemployed people cared what our GDP number was. I know I had promised to try to ignore the fundamentals earlier in the month but then they just started screaming at me so I just felt compelled to point out these silly little details like how can we have 3.5% growth when 5% more people lost their jobs? The report sounded like shenanigans to me so we decided to ride out the crazy move up and let our levels guide us for the day. As tempting as it was to flip bullish, I waned members: "Dow volume at 9:45 is just 22M so there is nothing to be read into this move up – we’re not the only people who are skeptical about this little rally." At 10:18 I ammended: "Don’t forget, I’m making a fundamental analysis of the GDP data but that doesn’t mean we shouldn’t just follow the market. If they look at 3.5% and decide the S&P is going back to 1,200, then that’s going to happen and we can short there. Meanwhile, the S&P hit resistance right at 1,056 and the Rut froze at 575 so we only have a spike bounce so far."

It was "GDPhursday – No Jobs for US!" and I asked whether 18M unemployed people cared what our GDP number was. I know I had promised to try to ignore the fundamentals earlier in the month but then they just started screaming at me so I just felt compelled to point out these silly little details like how can we have 3.5% growth when 5% more people lost their jobs? The report sounded like shenanigans to me so we decided to ride out the crazy move up and let our levels guide us for the day. As tempting as it was to flip bullish, I waned members: "Dow volume at 9:45 is just 22M so there is nothing to be read into this move up – we’re not the only people who are skeptical about this little rally." At 10:18 I ammended: "Don’t forget, I’m making a fundamental analysis of the GDP data but that doesn’t mean we shouldn’t just follow the market. If they look at 3.5% and decide the S&P is going back to 1,200, then that’s going to happen and we can short there. Meanwhile, the S&P hit resistance right at 1,056 and the Rut froze at 575 so we only have a spike bounce so far."

We did well with some VIX puts and selling short puts on the DIA (against our longer puts) and we took MORE SRS longs and we took some TNA and DDM covers (just in case) that lost of course but at 12:44 I got bearsish again saying to members:

Europe (thanks High) generally at the 1.25% rule, that’s almost just the bounce we expect off a 5% drop but perhaps a little bullish if they hold it. Our two leading down indexes, RUT and NYSE are both up near the 2.5% mark and leading the rebound as our other indexes are up 1.5%ish. Oil is through the roof on weak dollar and talk that OPEC will no longer price oil on WTIC and will switch to sour crude pricing standards so these are BS, non-fundamental reasons to rally all coincidentally coming on GDP day AFTER we hit oversold conditions when GS lowered our GDP expectaitions. Isn’t manipulation fun?!?

That led to a VERY profitable 12:52 short in the oil futures at $80.30, which finished the week at $76.99 but we just played it for the quick drop that day. We did a little bottom fishing on ELN and shorted SPG into earnings but that was it into the close as we removed our bullish cover plays and left ourselves bearish into the close, not all that impressed with Thursday's huge turnaround.

That led to a VERY profitable 12:52 short in the oil futures at $80.30, which finished the week at $76.99 but we just played it for the quick drop that day. We did a little bottom fishing on ELN and shorted SPG into earnings but that was it into the close as we removed our bullish cover plays and left ourselves bearish into the close, not all that impressed with Thursday's huge turnaround.

In yesterday's morning post, which I called "Frightening Friday – Halloween Edition," I said right at the top: "We would have gone more aggressivley bearish but we were worried about end of the month (and end of the year for many hedge funds) window dressing that would keep things going for one more day… Everything went according to plan and we got the bounces we were looking for but the RUT failed to retake 589, which was our canary in the coal mine’s breakdown level from last week. As I alerted members at 12:15, that and the Qs failing to hold 42 into the close, which failed to confirm the Nas move over our 2,088 watch level. We have our DIA puts, we have our SRS longs, we have our DXD longs (which are half price as our DDMs paid off yesterday) and we shorted SPG into the close as Cap noted they had a ridiculous run-up ahead of today’s earnings."

Gosh how useful would that information have been to a PSW Report Reader as even that FREE morning commentary with poorer entries than the members saw still let to great plays on the DIA (fell from 99.64 to 96.87), SRS (went from $9.95 to $10.78) DXD (from $33 to $34.85) and SPG (fell from $69.24 to $65.29), even without our clever option strategies they would have done very well on Friday.

Speaking of our Members, there is a very detailed discussion on using the Buy/Write strategy to build a hedged virtual portfolio in Thursday's chat session, as well as a series of disaster protection plays, following up on our August 24th article on the subject that is a must-read for Members and I’ll see about turning it into a Members Only Post over the weekend as we have 7 new buy/write positions and the 4 April cover plays that will be great to work into over the next week but those disaster hedges are already up nicely on Friday's move. My comments about the Thursday rally on Friday morning were:

Speaking of our Members, there is a very detailed discussion on using the Buy/Write strategy to build a hedged virtual portfolio in Thursday's chat session, as well as a series of disaster protection plays, following up on our August 24th article on the subject that is a must-read for Members and I’ll see about turning it into a Members Only Post over the weekend as we have 7 new buy/write positions and the 4 April cover plays that will be great to work into over the next week but those disaster hedges are already up nicely on Friday's move. My comments about the Thursday rally on Friday morning were:

Even if we have another up day today, we’re still going to want some pretty serious coverage into the weekend unless the Russell and the Qs can confirm this move up today. Bulls should be spooked by the fact that a blow-out GDP report, showing an economy with a HUGE turnaround and the President crowing on TV about how great things are going could ONLY erase 1/2 the losses we suffered since last week.

Like Pumpkin Jack in "The Nightmare Before Christmas," you can dress a skeleton up in a Santa suit but you are not going to fool THAT many people if there’s no meat on those bones. Overall, investors are a savvy bunch and they know when there is no Santa, especially if it’s a Santa Clause rally that may be missing this year. The September Personal Spending numbers are in this morning and consumers cut back 0.5% this month while drawing a flat Personal Income. Both are better than expected but both are down from August and both are down sharply over the past two years with Personal Income averaging 11% less than it was in 2006. That’s 11% less AND they are getting paid in dollars!!!

There is pretty much no way we’re not going to be at least 55% bearish into the weekend and the more of a pump we get today (if any) the closer to 60% bearish we are likely to get. As we did yesterday, we’ll be taking those quick-paying upside momentum plays that cover our bear sides as once we cash them out at the end of the day, we are right back to bearish without too much messing around.

It was fortunate that we took our bearish stance into the close on Thursday as there really wasn't much time to get more bearish in the morning as we got that "short, sharp shock" I had warned about quicker than expected. We did have time to flip naked (60% bearish) on our DIA Jan $103 puts, making a nice profit off the previous day's sale of the $100 puts in the 9:42 Alert to Members. We bought those $100 puts back for $2.45 and they finished the day way up at $3.80 but we did sell 1/2 the $99 puts at $2.70 and shifted our long puts to less delta, just in case the market gets silly again on Monday.

Of course we led off with SRS yet again, at 9:53 as that one has been working well lately (after killing us for 2 months) but the Michigan Sentiment Report kept us from getting too aggressive on the downside as did the ever-present fear of the stick. At 1:47 I warned: "If we’re going to get a move up, it needs to be here, otherwise volume will overwhelm the trade-bots" and we did get a brief attempt but it quickly failed. Still we kept our slightly more than 55% bearish stance over the weekend becasue, even though it looked really bad, I reminded members that the Dow was down just 3% for the week and flat for the month while the Nasdaq and S&P were still possibly able to bounce off their 5% marks. I even called 9,712 as the close at 3:18 so either the market IS fixed or I'm psychic – take your pick….

All in all, it was an excellent month of trading, albeit frustrating during that two-week period where the pump was on and our bearish plays were looking very questionable. Still it worked out spectacularly well in the end and I'll be looking next week for signs of where this will all shake out. Calculated risk has a great graphical wrap-up of October and we'll be checking that out but what kept us on the fence at the end of Friday was the fact that we were able to take non-greedy exits with great profits on our bear plays and my fear of government tampering after such a big sell-off. Already we see some evidence of this with this little news item:

All in all, it was an excellent month of trading, albeit frustrating during that two-week period where the pump was on and our bearish plays were looking very questionable. Still it worked out spectacularly well in the end and I'll be looking next week for signs of where this will all shake out. Calculated risk has a great graphical wrap-up of October and we'll be checking that out but what kept us on the fence at the end of Friday was the fact that we were able to take non-greedy exits with great profits on our bear plays and my fear of government tampering after such a big sell-off. Already we see some evidence of this with this little news item:

With $770B of the $1.4T in commercial mortgages maturing in the next five years currently underwater, FDIC revises its rules (.pdf) to allow banks to keep loans on their books as 'performing' even when the underlying properties no longer cover the outlay.

That's right – keep in mind that, when all else fails, they can always just change the rules! So, whether you are a bull or a bear – be careful out there. The last two times we were down 2% or more on a Friday were 10/24 and 11/14 of last year and both sell-offs were followed by 2.5% down Mondays. 9 more banks were closed on Friday but all through a purchase and assumption agreement with USB (backed by Buffett), who takes on the banks' combined deposits of $15.4B. How many more banks will fail in 2009? The current total is 115 and many experts think that's well off what the total should be if the books were being honestly appraised…