I’m just doing a quick wrap-up this week because, surprisingly, it MIGHT be time for a new Buy List!

I’m just doing a quick wrap-up this week because, surprisingly, it MIGHT be time for a new Buy List!

I had said to Members on Cinco de Mayo, in our 5% Rule Review, that if we broke below 1,155 we would retrace all the way to 1,100 with our 5% Rule resistance points around 1,100 at 1,155, 1,114, 1,100, 1,073 and 1,045. We actually spiked as low as 1,066 on Thursday but finished the week at a very sad 1,110 as we watched for that "weak bounce" zone to be broken all day. This does not bode technically well for the markets next week but I told Members we would have to give the markets a pass for the day. Based on the uncertainty of the weekend, we can’t expect a lot of capital commitments ahead of the EU decision. After all, we’re in cash – why shouldn’t other smart funds be too?

When I predicted we’d hit 1,000 on Wednesday, I did not think it would be on Thursday! The markets are now negative for the year and the S&P has spiked almost to the Feb low of 1,044 (and our lowest close was 1,056). That’s right, these 5% Rule numbers are the SAME ones we used back then and it’s the same series we used to measure our winter run at the end of last year. We expect a bounce here, hopefully at least a test of 1,155 on a relief rally if Greece is "fixed" yet again on Monday but we’re not going to be too impressed until we’re over that line.

Still that means it’s time to at least lay out a new Watch List, which is the prelude to a Buy List – giving us a list of stocks we’d like to get into at lower prices. Our last Member Watch List was back in December and by Feb 6th we had our famous Buy List, which we triggered at Dow 10,058 for a very successful run through March 18th ("Bye Bye Buy List!"), when we closed 2/3 of the positions and we have since cashed out the rest as I got more and more worried about the rally, finally calling for all cash last week.

Speaking of last week, for those of you who say I don’t pick enough straight stocks – I listed 33 short trade ideas from my unofficial "Sell List" last Friday (4/30) when the Dow was way up at 11,167 (clack, clack, clack) and I said:

Attention ladies and gentlemen:

The stock market will soon be leaving the station, please secure all personal items, pull down the safety bar (our Disaster Hedges) and keep all body parts inside ride at all times. Well you know you can follow all of the safety instructions and STILL get smacked in the face with a black swan (like our friend Fabio, pictured here) which is why we elected to get back to cash ahead of this report. The markets were just too insane this week and who the heck knows if Europe will still be a Union on Monday or what the GDP number is going to be (but I do think it’s a miss).

Since our biggest weekend fear is financial panic in Europe, our cash US dollars will become more valuable in a crisis and if the market drops, all the better as we can ride back in and do some bargain hunting.

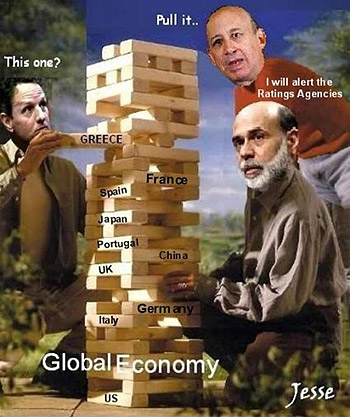

It remains to be seen whether we will firm up here, near the year’s lows, or if this is just a stop on the way to a retest of the zones around 8,650 on the Dow and 880 on the S&P, which is the "fair minimum value" of the Dow and S&P I determined back in our last crisis. It all depends on what happens in Europe as they are on the brink of a liquidity crisis – again – but this time it may not be so easy to paper it over with FREE MONEY as we’re starting from a much weaker global position and the mythology of China’s infinite growth saving the world is beginning to show some cracks even as Japan begins to melt down and our own Banksters all seem to be just one step ahead of the next investigation.

I brought all this up in that Friday’s post and it isn’t all going away just because we hit my target at S&P 1,100 and tested our Dow 10,200 goal as well. As we now cashed out of our shorts too, it would be nice to say we don’t give a damn but I think we’d be happier with a panic drop at this point to get some REALLY good entries (sorry bulls) but we will be looking for some bargains along the way (see yesterday’s post with our "Buy/Write" strategy). While we got out of our shorts on Thursday, we were not in much of a buying mood on Friday but we’ll be watching our sell list group for signs of life:

Bang, pow, zipf! Holy hemorrhage, Batman, these stocks are melting like Mr. Freeze’s base in Eyjafjallajokull! Hey it’s the weekend, I’m allowed at least 5 pop culture references… Usually we don’t bother shorting stocks because they don’t usually move like this. Obviously, the puts on these stocks made ridiculous amounts of money but, as I said in last week’s Wrap-Up, when we buy a naked put OF COURSE we are short on a stock and, when we buy a naked call – OF COURSE we are long on a stock…

These stocks are not stocks we usually short, this was simply a list of power stocks that had simply gotten way too ahead of themselves and made for compelling shorting opportunities that week, when I was actually looking for things to buy. But, as I said to our Members: "It was easier to construct a Sell List than our usual Buy List for this market." BIDU was a key short for us – why mess around with the little ones when BIDU was so obviously overpriced. As I said in our cash-out post on 4/29: "Cash doesn’t mean sitting on our hands, cash means flexible. Cash means being able to grab opportunities like the chance to sell BIDU calls to suckers this morning and the chance to short oil at $85 again."

These stocks are not stocks we usually short, this was simply a list of power stocks that had simply gotten way too ahead of themselves and made for compelling shorting opportunities that week, when I was actually looking for things to buy. But, as I said to our Members: "It was easier to construct a Sell List than our usual Buy List for this market." BIDU was a key short for us – why mess around with the little ones when BIDU was so obviously overpriced. As I said in our cash-out post on 4/29: "Cash doesn’t mean sitting on our hands, cash means flexible. Cash means being able to grab opportunities like the chance to sell BIDU calls to suckers this morning and the chance to short oil at $85 again."

Oil is now $75 and the futures contracts pay $10 per penny for being on the right side. A single short futures contract at $85 is now worth $10,000, not a bad return for 7 trading days! Of course also we shorted USO calls our morning Member Alert, where I said: "Oil can also be shorted by selling USO $41 calls for .95 as that’s the $85 line on oil that we don’t think will hold."

Well this was just like shooting fish in a barrel wasn’t it? 18 for 18 is pretty good so far. To be fair, the Dow is down 7% since that Friday so let’s say my only winners were ones that did better than that. Keep in mind these are all stocks I was looking at when looking for things to buy so, for the most part, we’re actually kind of interested in them as they get cheaper. Right now I’m taking notes of who went down LESS than the Dow and the S&P and, especially the ETFs they belong in (all part of our usual analysis) and we also like ones like SHOO and FAST above who, so far, are respecting their 50 dma (red line) after a nice pullback.

As you can see from the above set, our indexes had no respect at all for their 50 dmas and the Russell still has a long way to go before testing the February lows. If they hold that 650 line, which was their breakout level in March, then we have a positive signal next week but, if they blow it, the other indexes are likely to blow their 2010 lows and we’ll have to be looking as far down as another 20%, back to our non-spike lows. Cash is still king until we see these supports retaken but, of course, we know how to buy stocks at 20% discounts so we can begin scaling in earlier than the average investor, giving us a huge advantage when the market is in panic mode…

Man am I good (pat-pat)! Anyone can go with the flow but how many people are willing to tell you a stock that does nothing but go up is going to fail the day before it fails? With options, timing like that is key because we get MUCH better entry prices on short calls and long puts when we initiate out bets while the momentum is going against us. It’s like trying to catch a perfect wave though, very tricky and that’s why we always scale in carefully and we do love our hedges. We were already rolling a bunch of short positions we entered a little too early in April, where we had to use the old Rawhide Strategy (rollin’, rollin’, rollin’) to stay on top of the surging wave of buyers. An example of that strategy was in an 11:20 comment to Members and I’ll print my whole comment from chat from that morning (11:20) as it’s educational:

Phil

April 15th, 2010 at 11:20 am |

Oil is the only thing taking a break – down to $85.60.

Well, this is a nice surprise, TOS moved my EDZ short puts for free but not a small position (5) I had on FAZ so I guess they automatically adjusted larger positions – very nice!

AMZN/John – Keep your head in the game, AMZN is only at $146 and that’s up 25% since March 1st – something some would consider extremely ridiculous. They had great earnings in Jan and only made it to $132 and then sold back to $115 and Nov earnings also took them to about $145 before a spectacular failure. It’s kind of like boxing where you have to learn to take a punch and move on because you WILL take punches – it’s part of the game. So there is no reason to do anything with the May $145s at $8.90 and 85% premium. The Apr $140s are $6.50 and you can roll those to the May $150s evenish so that’s the position. If you want to get conservative into earnings you can sell 1/2 of your total position in May $135 puts for $3.75 as that will help pay for a roll-up if AMZN heads higher but if your gut says not to sell $135 puts – I’d go with that as you can roll the May $145s up to the Oct $160s (now $9.30) and THEN sell Oct $145 puts (now $14.60), which sucks for time but you get my point – we call it the Rawhide strategy!

BIDU/RMM – There is a legitimate reason for BIDU to go higher. GOOG had 1/3 of the business in China and BIDU 60% and now GOOG is gone so BIDU can, in theory go up 50% ($750) and maybe even more as they now have a monopoly. I thought MSFT or Yahoo (Ali Babba) would get more aggressive but they haven’t and more and more business is defaulting to BIDU but it won’t show up in revenues fast enough to justify this run most likely but after an earnings dump, then they will be a solid buy.

MBI/Micro – I like it a lot. You could be a little safer and sell the Aug $8 calls for $1.70 and the $7 puts for .90 for a net $5.75/6.38, which is still a very nice 39% if called away at $8 with a nice 23% downside cushion in a non-greedy play.

TZA May $6 calls at .42 is my bearish play of the moment

We get a lot of questions about what subscribers get as Members and this comment is a good example of it. It’s a mix of me and other clever people answering Member questions and coming up with trade ideas. If I bold a trade idea, even if I’m discussing it with someone else, that lets Members know I think it’s a generally good idea (as opposed to a strategy I’m discussing that’s specific to someone’s question). As you can see, we were pretty bearish even then and my comment to John is a great explanation of the the logic of how we ride out a move against us (AMZN is now $125 so that all worked out quite nicely!).

EDZ and FAZ are trades we were already in and, of course, phenomenal winners while new trade MBI is still well over $8 ($8.73) and we’re good on them all the way down to $7 while the May $6 TZA calls are now $1.68, up 300% in 3 weeks. So, not bad for 6 paragraphs, right? Also notice, at the time, I was bullish on BIDU so my position the day after earnings was one of my classic "flip flops" I get accused of by Cramer and Co but the reality is there’s my target right there. Is it really "flip flopping" to go short at my topside target?

Getting back to our list, another cool play we made on earnings was WYNN, where I had these two ideas on the 29th in Member Chat:

WYNN/Hannah – Well that is a lot of money but wouldn’t you rather wait for $100? I guess if you are impatient you can sell the $95 calls for $3.65 and those can roll to the June $100s ($3.35) and those to Sept $110s ($4.15). If you want to do a bear spread, you can sell the June $105 calls for $2.05 and take the $100/95 bear put spread for $3.20 so net $1.15 on the $5 spread but, opposite of our usual plays, you have to REALLY want to be short on WYNN at net $103.85 at June expiration.

You can see WYNN dropped like a rock so the June $95 calls should expire worthless (currently $1.40 up 61%) and the spread of the short June $105s and the $100/95 bear put spread is now net $3.60, up 320% – so you can see why I liked that trade better… Wynn is a great example of what I mean by getting great prices when the move is against you as we the "incredible" (as in not credible) rally gave us great prices on the calls we sold ahead of earnings as well as a cheap entry on the puts. That’s the difference between Fundamental and Technical analysis – we DON’T believe that you simply follow patterns and then adjust AFTER the market turns against you – we prefer to stay ahead of the curve and our biggest problem is usually that we are too far ahead – which is why we have our Rawhide Plays – fundamentals do tend to win out in the end.

So the Short List was perfect (it ends at OIH) but I blew 2 by trying to get bullish with SPWRA and TBT and we also had MON and VLO as upside choices and they are down as well but, of course, we didn’t stick around in the bull plays to find out other than our long-term, well-hedged positions – which we’re very happy to add to as we get lower. As to the short side, we cashed out Thursday – that was plenty for us and maybe we’ll miss a spike up on Monday or maybe we’ll miss a spike down but I know we’ll sleep a lot better on Sunday than most of the other Hedge Fund managers I know…

Quick Week in Review

In "GDWheee Friday – Could be a Wild Ride!" I said something seemed fishy in the GDP report, keying on the Real Disposable income numbers as a negative sign and I closed with: "Like last Friday, we’re going to let the markets run but unlike last Friday, I’m glad we didn’t wait until the weekend to decide to get out. We’ll see if I was right." We did fall off the initial excitement of the GDP report but that didn’t stop my "friendbuddypal" Jim Cramer from telling the sheeple:

I suspect on a better unemployment number) you’ll see a substantial rally in the markets and most importantly, the banks. Yup, the very banks that were taken down so wrongly today due to ill-conceived chatter stemming from financial regulatory reform…

Do we have to wait for this number to be reported on Friday to buy stocks? Absolutely not. Not after the shellacking we took today.

Cramer said he thinks the bank stocks would rally of their own accord.

However, if I am right and the household number shows a big downtick in unemployment, and if a consensus on financial reform begins to develop next week, as I believe it will, you could have the beginning of a monster rally in the financials.

I don’t know if Fast Money’s advice was as awful as Cramer’s because they pulled the first half of the show off the web site but I’m sure their advice was brilliant. I detailed our plays in last week’s Wrap-Up so I won’t rehash it here although we do (purposely) leave out details of many of our member spreads to protect our positions. Now that we’re done with them, I can tell you we had sold the EUO Aug $20 puts, which made 50% already, the EUO Aug $21/25 bull call spread at $1 that doubled, along with our ABX and QID plays that are looking very, very good indeed.

Optrader and I updated "Smart Virtual Portfolio Management I – The $10,000 Virtual Portfolio" last Saturday and this Saturday we need to finish up the $100,000 Virtual Portfolio and then the $1M Virtual Portfolio for our Members and, of course, I have a Watch List to prepare so I’ll just summarize the rest of the week quickly so I can get to work:

Monday Munificence – Greece "Fixed" for "Only" $146Bn, Who’s Next?

Monday Munificence – Greece "Fixed" for "Only" $146Bn, Who’s Next?

I made my case for skipping over the European dominoes, right to the house land of the rising sun – Japan, whose 200% debt to GDP ratio is the most horrible economic thing to be ignored by the MSM since $85 oil (back in 2007, when I shouted myself horse for a year saying it would end in disaster and no one believed me – until it did).

We had the Times Square bomber over the weekend and I was dumbfounded that it was being ignored by the markets. I not only reiterated my cash call but I suggested stocking up on guns and ammo as a hedge against the collapse that lies ahead. As to the markets, my comment was:

At PSW, we often target stocks that are "priced to perfection" for our short positions and my primary objection to the run-up to S&P 1,200 is that 1,200 is, in itself, priced to perfection and the global economy still seems far from perfect to me as well as the obvious possibility of another 9/11 or some other catastrophe, like an oil spill wiping out the entire Gulf of Mexico’s water economy.

Later on in chat (at 12:09), with the markets heading up to day’s highs, I said to Members:

Woops, Euro plopped to $1.317 into EU close. Pound holding $1.524 and dollar is at 94.5 Yen so Nikkei futures are happy as long as that scam continues. Copper is $3.28, a 2% drop for the day so I think you are NUTS to be bullish right now – JMHO….

At 3:50, we were closing at the day’s highs and I said:

Notice, by the way, that all we are doing today is making lower highs than last week. This rally means nothing but setting a downtrend if we don’t pop over those levels – more on that when I get a chance to run my numbers.

Some of those numbers and charts and graphs come at 7:14 (we chat 24/7) and it’s too long to list here but here’s a link to an infographic you MUST see that we were discussing that night as one of the reasons we’re in a LOT more trouble than our government and the MSM would have you believe. Speaking of the MSM – thank goodness our man Cramer was on the case – telling us that the move to make after a 5% jump in the Financials that day was…. To buy MORE Financials. Cramer criticizes we who dare to criticize him by suggesting people be a little more cautious at the top of a 200% run. Silly us, right?

Tumultuous Tuesday – Funds Tend to Short Ten-Year Treasuries

Probably our biggest mistake of the week was not considering the flip side of this indicator – that there could be a huge squeeze on TBills that sends our precious TBT back near it’s lows. That’s exactly what happened but we’re long-term buyers of TBT and we just took advantage of the deals – this is one we do not flip or flop on… I pointed out the fallacy of the Auto numbers and discussed how I still liked shorting oil (which had topped at $87) but that gold had gotten too dangerous for naked shorts. I put up charts on the major indexs and talked about how ridiculous the performance of US equities was compared to the global markets saying:

So it is a truly gravity defying performance put on by our US equities as they float high above – NOT JUST THE 50 DMA BUT, ladies and gentlemen, for perhaps the last time on the World stage in 2010 – the Flying US Indices will attempt to float above the 20 Day Moving Average in order to LIFT the other Global markets back to the very top of Wall Street’s big top. Come and see the show! …Did I mention copper and our relentless shorting of FCX yesterday? Copper hit $3.25 this morning and FCX is looking at $72.50 – look out below if they break lower!

That afternon, my 2:35 comment to members was: I think we may be at the beginning of a major correction. If the EU starts unraveling, anything could happen. Don’t forget our meltdown really started with troubles in Iceland and Ireland even though it turns out that our local issues were 100 times worse than what actually triggered the global sell-off – How is it different now?

3:46: Finishing near day’s lows not at all bullish. Means we’re very likely in at least a 5% correction with the normal follow-through 1.5%, .75% and then dribbling into the line (assuming we decelerate and 5% holds).

Cramer disagreed with me yet again. Telling viewers: "The shorts and panicked sellers have a “buffet of horribles” to choose from to try to knock down this market. But that’s no reason to sell and run." This was AFTER he had a chance to read my totally opposite take in my post "5% Rules! How Can We Be So Right?" where I made the 1,100 call for the S&P I mentioned above.

Wednesday Worries – Greece Closed & Japan Close to the Edge

Wednesday Worries – Greece Closed & Japan Close to the Edge

As I had said about the last Thursday’s "Pain in Spain" article – never ague with articles whose titles are plays on popular songs. I suppose there aren’t enough Yes fans around these days or maybe there never were but one of my college roommates used to play them constantly and it’s all still bouncing around my head to this day… Where were we? Oh yes, so the riots in Greece were starting to bother me and I led off my commentary with this illustrative comedy sketch:

Lord Blankfein, the peasants are revolting! Lloyd: "I know, they stink on ice."

I quickly got deadly serious on the subject as it’s one I’ve been gravely concerned about for years and, in fact, has been my overriding economic theme which I laid out way back in December with: "2010 Outlook – A Tale of Two Economies." If you want to know what’s going on in the World now – just read what I wrote then. As I said in Wednesday’s post:

It’s one thing to have these egg-headed discussions about austerity and cutbacks and for the EU and the IMF to get together and tell the Greek people it’s time to pay their debts but it’s quite another thing to actually get it past the people who’s lives these measures will affect. Imagine if the IMF told Americans that we needed to cut government spending by $1.5Tn (the equivalent) and that wages would be frozen and retirement will be raised from 65 to 70 effective immediately so hopefully you die at work and save us the Social Security payments…. We have Tea Party protests now! …Putting the global cherry on top of our EDZ and EUO hedges is State Street Global, who put an "underweight" position on the largest emerging markets including China and Brazil on concern shares are expensive relative to smaller developing nations as economic growth slows.

Of course, EDZ has been a main hedge of ours for ages and EUO I mentioned we entered last week but, even if you just took that advice in the monring you could have caught a 20% run on EDZ within 30 hours as well as a 4% move in EUO over the same time frame. WHO SAYS I NEVER PICK STOCKS?!? Despite the upbeat looking morning I closed the post with:

1,157 on the S&P, right where I said we’d be at the conclusion of our 5% Rule Review! I also said "not holding that is going to be nasty" so look sharp today as we exepect at least a 1% bounce off that line. Anything less will be LAME! Of course we are in disaster hedge heaven because THIS IS A DISASTER! We’ll be looking at layers to go lower and also as a way to lighen up because, the same way we took 300% profits off the table on the way up, we need to do the same on the way down.

It turns out the long-term disaster hedges could NOT be taken off the table because the rapidly rising VIX made it difficult for us to buy back calls and puts we sold to cover but, fortunately, I knew that mignt happen and suggested 2 shorter, more aggressive hedges in DSD and QID in my 9:50 Alert to Members:

Phil

May 5th, 2010 at 9:50 am |

Wheee doggies, what a move!Those bottoms I mentioned yesterday are: Dow 10,800, S&P 1,170, Nas 2,400, NYSE 7,430 and Russell 690 – I’m really surprised we’re here in 24 hours and I sure hope the Dow and RUT hold it together or this will go beyond ugly! 3 of 5 below is a terrible signal already…

Certainly this is not time for bottom fishing so we need to get over yesterday’s afternoon highs before we even think about buying something – no matter how cheap it looks!

Spain’s 10-year spread just hit a new all-time high compared to Germany so that’s a crisis that’s not going away today.

SDS is at $31.25 and you can buy the June $29/33 bull call spread for $1.60 and sell and sell the $29 puts for .80 for net .80 on the $3 spread and SDS bottomed out at $28.37 so you are really betting that the S&P won’t flip around and fly back over 1,200 so fast you can’t get out of the spread. Meanwhile, if we keep going lower, it’s a nice 275% gain.

This is the kind of play you want to roll 1/2 of your profits into if your original Disaster Hedges are already way up. Then you put a 50% stop on the new set and you lock in 75% of your current profits while keeping another 68% upside from your original position.

Another big hedge is QID June $15/17 bull call spread at $1.05, selling the $15 puts (lower than QIDs lows) for .50+ (now .30) if QID ticks lower but otherwise, gaining .95 off $1.05 in a month is just fine!

Remember these are ROLLS so we can take out WINNING short plays OFF THE TABLE – I do not like these as new plays unless we fail to bounce.

My favorite upside play at the moment is ERX June $37/41 bull call spread at $2, selling May $30 puts for .60 for net $1.40 on the $4 spread (180% upside) and June puts can be sold to further reduce the basis.

SDS $29 puts are still .80 but $4.97 out of the money now. The June $29/33 spread is now $2.20, up 37% but 100% in the money towards its 275% potential gain. QID June $15 puts held .25 (up 18%) and the June $15/17 spread is $1.35 for another 28% gain with QID at $18.50 we’re well on our way to goal. ERY went completely the wrong way (that will teach me to be bullish on oil!) and the June $37/41 is down to $1.30 (down 33%) and the May $30 puts are now $2.85 (down 103%) even though ERX is still at $33.82 so I still like them as a naked sell. Again, convictions are the big difference in fundamental trading. One of the reason we do these reviews is so that we can go back in time and observe the ups and downs and adjustments of our trades over time.

Cramer explained to us that the market was "like a roller coaster" and exhibiting bi-polar behavior. See if you can figure out if he’s saying to get to cash or ride things out. It’s great commentary because he can quote himself no matter which way things go. But, according to his own web site for the day: "Cramer’s bottom line is this: Investors don’t need to constantly obsess about Europe’s debt problems. They’re better off using these declines to buy stocks with great long-term secular growth stores or those that just delivered the best earnings beats of the season." Cramer’s disdain for "obsessing over Europe" (or gold or oil or China – yes, he said this!) and carnival-like barking for trying to keep people "in the game" and pulling cash off the line led me to create the following montage response (with a soundtrack you can click on too): We Won’t Get Fooled Again?

Foolish Thursday – Through the Looking Glass

Foolish Thursday – Through the Looking Glass

Down the rabbit hole we went on Thursday! I said about the photo post that morning "That pretty much sums up my attitude on the markets right now – we cashed out at the top and, until we see some pretty DEFINITIVE proof that it was not a top, we’ll be sticking to mainly cash, thank you very much! While Alice’s Red Queen may have said "Sometimes I’ve believed as many as six impossible things before breakfast," we’re having a little trouble swallowing what’s being dished out by our government and the MSM."

I cited Richard Davis’s article on the lagging GDP as well as articles in our Phil’s Favorites section as examples of thing people need to read before deciding to go bottom fishing. As I said that morning:

While it’s tempting to try to bottom fish on the dips (and boy have the little maze rats been trained to buy on the dips this past year!) I keep having to point out to Members that we don’t actually KNOW where the bottom is. I wrote up our major watch levels in our 5% Rule Post article (and there is more discussion in it in chat on that post). To simplify a long discussion, our key watch levels on the S&P are going to be 1,176 to the upside and 1,155 to the downside. If we can’t hold 1,155 then the markets are in for a World of hurt and we’ll be looking for a move all the way down to 1,100 at least.

Whatever you do, DO NOT SUBSCRIBE TO PSW, knowing this sort of thing a day before it happens will make people think you are one of those people who know what’s happening or, even worse, have money – a very dangerous position to be in "when they kick in your front door." Not to get off topic but I was involved in what I thought was a serious conference call regarding possible solutions to the Greek crisis when one of the participants said: "What they need to do is find the 10 biggest tax cheats in the country, drag them into the middle of downtown Athens and shoot them on TV." This is, unfortunately, not that different from some of the rhetoric at rallies in this country (or on Fox).

The day’s article is a must read if you want to get a handle on how screwed up Europe is and, as of noon on Saturday, it isn’t "fixed" yet so despite Cramer’s insistence that we’re worrying too much about Europe – we may have a lot to worry about on Monday if this thing isn’t resolved! In the morning post, I pointed out how insane (and fake) the Hang Seng looked in the afternoon and I concluded: "I would love to tell you there’s a great way to play this but there’s a reason we went to cash. As the great tradebot, WHOPPER once said: "Sometimes the only winning move is not to play."

We did end up playing as we bottom fished and cashed in our shorts during the madness of the day. Cramer said that too was a mistake we’re making and that "Until we suffer a truly vicious decline, a legitimate one that takes us under Dow 10,000 for real, this market is probably too volatile for most individual investors." Cramer also tells us that "Dow drop was caused by a trader who tried to sell $15 billion worth of stock instead of the $15 million he’d intended." Wow, Cramer must think we are real idiots….

Fat Finger Friday – Business as Usual, Really

Fat Finger Friday – Business as Usual, Really

Hey SEC, here’s an idea – while you are spending 3 months determining what actually caused the market drop, why not send out a note telling MSM whores like Cramer and Co. that you won’t put up with them misleading people with their "inside" information that the sell-off was caused by a mistake and that the market isn’t really that fragile. That in itself can be more damaging to people’s financial health than the original drop – sending the suckers into the dip-buying pool while the sharks may still be in the water. Of course, when you are one of the sharks, or the Mayor of Amityville, I guess that’s just what you do want to do, right?

Of course we have a huge advantage over the average investor as we know "How to Buy Stocks For a 15-20% Discount" so we can make our entries now (INITIAL ENTRIES) and we’re protected all the way down to about 8,200 – which is the level we want to be buying heavily at anyway. So a simple 1/4x entry here with 20% downside protection and the plan to double up if we drop (2/4x) and then DD again to a full 4/4x position if we drop another 20% to 7,000 is not a bad plan for making a few entries on stocks that are a great deal. I put up and example of a play on MEE in the morning post and suggested similar for RIG.

Do keep in mind that that is what I’m talking about when I’m suggesting entries in this chop. I’m talking about committing 1.25% (1/4 of 5%) to several new entries on stocks that we consider great deals. We don’t know at all whether it’s a good time to buy yet, only that we will regret it if we don’t and there is some coordinated action by the G7 to pump up the markets on Monday (very possible). As I said in Friday’s post:

Meanwhile, nothing is better and nothing is fixed and don’t believe a word they say about "fat fingers" causing the crash. This crash was caused because a little boy finally pointed out that this Emperor of a rally actually has not clothes and all the MSM analysts who have been fawning over the magnificence of the rally are once again revealed to be nothing but fools, yet no greater fools than those who follow them…

Meanwhile, I have a Buy List to work on. Cramer has his minions going to cash, selling all the stocks he just told them to BUYBUYBUY earlier in the week. In fact, Cramer says "Don’t Buy Till Dow 9,000" and that suits us just fine as we (and Cramer’s hedge fund buddies) will have our pick of the litter if we decide it is really safe to go back in the water. More on this as the weekend newsflow develops. Call me crazy, but I do like to keep up with what’s going on around the world