This was a LONG year.

This was a LONG year.

I was in Thailand this time last year, working on a project with the Thai Government to bring medicinal cannabis to the country with Hemp Boca and New Age – two of our PSW Investments partners. As with most things in 2020, that project is now on hold but it seems like a different world where I went to an airport and got on a plane and walked around a crowded terminal without a mask on, etc.

I'm 57 years old and there's been no point in my lifetime where the world has changed so drastically. World War I was the "war to end all wars" and then there was the 1918 Pandemic and then the Great Depression and then World War II (since the "war to end all wars" didn't, they decided just to start numbering them) and then we had a nuclear arms race then a global recession in the 70s and then the financial system melted down and now this – it's always something, isn't it?

My Grandpa Max was born in 1903 and died in 1999 – having caught most of the action and it always gave me the perspective that "this too shall pass" though, while you are in the thick of things – it sure doesn't seem so, does it?

We started this year optimistically with "2020 Vision – Looking at the Year Ahead in the Markets" and we called for a long on Oil (/CL) at $61 and a long on Natural Gas (/NG) at $2.16 and Natural Gas topped out at $3.40 in November but Oil hit $65 in January but then collapsed to $10 in April and is only back to $48 now.

On January 15th it was: "Working it Out Wednesday – Is the Trade Deal the Beginning or End of the Rally?" – remember the trade deal with China? Hard to believe that was our top concern a year ago. That day, our Money Talk Portfolio had just 3 trades in it:

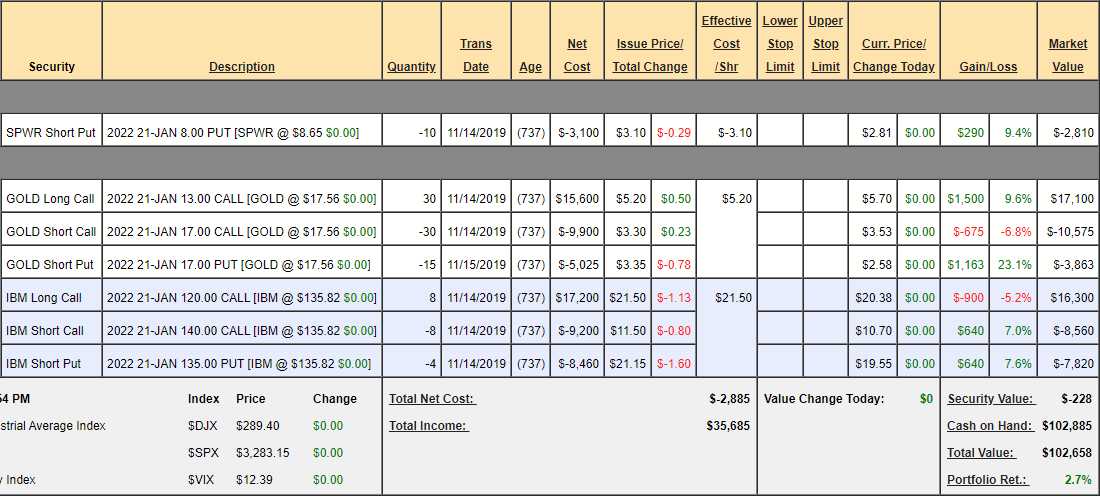

GOLD and SPWR were clearly outperformers but IBM is lower than it was at the time but, fortunately, we took advantage and rolled our long calls lower so now we're at:

| IBM Short Call | 2022 21-JAN 140.00 CALL [IBM @ $124.34 $0.00] | -8 | 11/14/2019 | (386) | $-9,200 | $11.50 | $-5.65 | $-5.50 | $5.85 | $0.00 | $4,520 | 49.1% | $-4,680 | ||

| IBM Short Put | 2022 21-JAN 135.00 PUT [IBM @ $124.34 $0.00] | -4 | 11/14/2019 | (386) | $-8,460 | $21.15 | $2.18 | $23.33 | $0.00 | $-870 | -10.3% | $-9,330 | |||

| IBM Long Call | 2022 21-JAN 110.00 CALL [IBM @ $124.34 $0.00] | 8 | 3/12/2020 | (386) | $9,600 | $12.00 | $7.30 | $19.30 | $0.00 | $5,840 | 60.8% | $15,440 |

This is still just net $1,430 on the $24,000 spread and all IBM has to do is get back to $140 over the next 12 months for a potential $22,570 (1,578%) profit. You can just do that one trade and call it a year!

On Jan 21st it was: "Trumped Up Tuesday – Let the Impeachment Begin!" but on January 27th, I warned: "Viral Outbreak Infects Global Markets", saying:

On Jan 21st it was: "Trumped Up Tuesday – Let the Impeachment Begin!" but on January 27th, I warned: "Viral Outbreak Infects Global Markets", saying:

Chinese markets are closed for the holidays or they would be down too as about 3,000 people are now infected by the coronavirus and it was 1,000 when I warned about it on Thursday so we're close to 50% daily increases in infections and we still aren't clear on the incubation period of the virus and we have no treatment for it either. That is, as we say in the medical community – NOT GOOD!

Do you have an extra $1,000,000,000,000 set aside in case of emergency? We'll find out who does and who doesn't as China has already pledged $9Bn to help contain the virus and, if you do the math, that's $3,000 per infected patient in a country where health care costs are 1/4 of what we spend in the US. Let's hope the infections level off soon but there's not likely to be a quick fix to this thing and, even in the best case, China is shut down for 2 weeks and that's going to hit the GDP for about $400Bn (2.8%) – so the effect on Global Markets will be lingering.

Sadly, it turns out $1Tn was a very low estimate for what would be required as the World ended up spending $14Tn (so far) fighting the virus. By Feb 10th the virus had clearly spread to the US and it was: "Monday Market Movement – 40,000 Infection, Almost 1,000 Dead – Why Worry?" Then we started crashing:

- (2/13) $10,000 Thursday – Hedging Pays off – Again!

- (2/14) Valentine’s Day Virus – Dow has 30,000 in Site

- (2/18) Turn Back Tuesday – Virus Fears Heat Up over the Weekend

- (2/28) Friday Flip Flop – Warsh Calls for Rate Cuts – Market Continues to Panic

- (3/11) Wednesday Weakness – $1.2 Tn in Payroll Tax Cuts Aren’t Enough to Stop the Slide

- (3/12 – Money Talk) Thursday Failure – Trump Shuts Travel, Provides No Solutions, No Stimulus – Market Tanks (again)

- (3/13) Federally Fueled Friday – Fed Buys a Rally for $1.5Tn – Will it Last?

- (3/17) 2,400 Tuesday – S&P Tests the Bottom of our Target Range

2,191 was where we bottomed out a bit later but we were turning bullish at the bottom because, as I noted on March 24th "Turnaround Tuesday – Yes, $3Tn is a LOT of Money!"

MORE FREE MONEY!!!

We're closer to it today than yesterday so the markets have gotten over their temper tantrum about yesterday's delay and now counting the uncountable riches that are about to be thrown around by our Government and our Federal Reserve as well as all the other Central Banksters around the World and we're even having an emergency G20 meeting to discuss even more bailouts for our Top 1% Corporate Citizens because they should never ever suffer the consequences of their bad decisions – like letting the Oligarchs run the World, leaving us totally unprepared to handle a Humanitarian crisis (I know, so many big words to look up!).

That same day we did our March Portfolio Reviews and you can see all the key bullish adjustments we made to take advantage of the sell-off. That's why we had such a fantastic year – we were worried about the virus early and we shifted gears at just the right time when the stimulus began. As I said at the time:

Well, here we are, at the bottom of that 40% sell-off and, as expected, we're having to pull a bit more cash off the sidelines as some of our new portfolios got crushed. This is going to be an odd review because we made more than one adjustment in the past two weeks on some portfolios and I'll do my best to consolidate all the moves here. The bottom line is we got a lot more aggressive around March expirations (20th) and yesterday (23rd), as the market hit rock bottom, we went gung-ho bullish in our LTP and Butterfly Portfolios in anticipation of a massive Congressional Bail-Out Package.

Hopefully, that provides a catalyst to form a floor at the 40% off line and we can consolidate between here and the 20% off (the top) lines, which is where the market should be in the first place – the rest was just fluff – that's why we cashed out in September – at S&P 3,000!

That's been the story of the year since then – the Fed never did run out of ammunition and the rally is still going.

That's been the story of the year since then – the Fed never did run out of ammunition and the rally is still going.

- (4/9) TGI Thursday – Up 20% From the Lows, What Happens Next?

- (4/14) Two Million Infections Tuesday – US Has Over 25% of the World’s Cases

- (4/21) Tumblin’ Tuesday – They Will PAY You to Take Their Oil

- (4/22) Wednesday Weakcovery – Does $500Bn Even Help Anymore?

- (4/30) Faltering Thursday – Wrapping up the Best Month Since 1974

We can consider this week's whole 5% a buffer but I'll feel better reducing our risk by removing some longs, raising our cash and that, in turn, will make our hedges stronger – because they have less to protect. We'll keep an eye on gold, which is selling off sharply as everying is "fixed" and America is going back to work, as well as the VIX, which has been calming down (another big boost to our premium-selling portfolios).

We'll see how long all this "great" news lasts as they look to reopen the states. My main worry this week was going over the 1M infection mark (check) and passing the number of deaths we had in the 20-year Vietnam War (58,000 – check) but that doesn't seem to bother anyone and now we have miracle cures and vaccines are on the way – so why shouldn't we be celebrating?

Maybe none of it's true but, for now – let's enjoy!

(5/7) Thrilling Thursday – Futures are Up because… Who the F**k Knows?

(5/7) Thrilling Thursday – Futures are Up because… Who the F**k Knows?

Don't ask me to explain this BS.

Yes, I know it's my job to explain this BS but sometimes I'm like Leonard Nimoy at the end of "In Search Of" when he would say "That is some strange sh*t" – or at least that's how I remember it ending…

Speaking of ending, Trump is sending everyone back to work and wanted to disband the Coronavirus Task Force (people freaked out, so that's off for now) and, as usual, it takes less than 24 hours for his BS to be exposed as YESTERDAY the US once again led the World with 24,245 new infections, bringing our total to 1,228,457 so that's a 2% increase for the day which (doing the math for our Fox viewers) is a rate of 60% more per month, which would bring us to just under 2M infections in the next 30 days WITH THE LOCKDOWNS.

But nooooooooooooooooooooo!, we're not going to continue the lockdowns are we? Lockdowns are for pussies and we're Americans and Donald Trump says (literally, he actually said this) that we should be good soldiers and march back to work and many of us will be injured and some of us will die (more than Vietnam already) but the virus is our enemy and the way Trump wants to defeat it is by throwing American lives at it until it gives up!

-

(5/14) Thirty Five Million Thursday – 2 Months of Rising Unemployment

(5/14) Thirty Five Million Thursday – 2 Months of Rising Unemployment

- (5/22) Friday Follies – America Heads to the Beaches

- (6/3) Which Way Wednesday? Just Kidding – Markets only go Up!

- (6/10) Which Way Wednesday – Nasdaq 10,000 Edition

- (6/29) S&P 3,000 Holds as We Pass 10M Infections, 500,000 Deaths

- (7/1) Fauci Fears 100,000 New Cases a Day, Market Soars

- (7/13) Portfolio Protection Workshop Part 7 – 20 Crisis Trades Revisited

- (7/16) Mask On Thursday – Surging Virus Numbers Push Many States to Lock Back Down

- (7/27) Monday Morning Markets – More Stimulus as We Wait for the Fed

More free money!!!

The Senate Republicans are expected to vote on the CARES Act 2 (it's a 5-act play) and this will be the beginning of two weeks of negotiations with the House, who already voted on a much more extensive measure to prop up the economy. The $600 weekly unemployment benefit will expire on Friday and most economists predict a complete disaster if that's not extended to 30M unemployed Americans. "We're not going to pay people more money to stay at home than work," US Treasury Secretary Steven Mnuchin said Thursday on CNBC using the poor grammer of a person who's never worked a day in his life and has sold his soul to Satan.

- (7/31) Thank Tech it’s Friday – Apple and Company Boost the Markets

- (8/11) 20 Million Tuesday, 28,000 Tuesday – Record Infections, Record Highs

- (8/14) 1933 Friday – Best 100 Days Since the Great Depression – Markets Love Mayhem!

- (8/27) GPDThursday – Can Powell Reassure the Markets?

- (9/2) Record High Wednesday – Up, Up and More Up

- (9/10) Thursday Failure at 3,420 – Are We Heading for a Real Correction?

- (9/22) Terrible Tuesday – Powell Says US Faces Slow, Uncertain Recovery

- (10/2) Schadenfreude Friday – Trump Catches Corona

- (10/6) Tempting Tuesday – A Sinking Dollar Lifts All Ships

- (10/14) Wednesday Worries – 25% of Small Businesses are Closed

- (10/20) Tipping Point Tuesday – Schrodinger’s Stimulus Moves the Market

? "Mr. President, you’re right about one thing: the American people are tired. They’re tired of your lies about this virus," Biden said in a written statement. "They’re tired of watching more Americans die and more people lose their jobs because you refuse to take this pandemic seriously. Now, more than ever, we need a leader to bring us together, put a plan in place, and beat this virus — but you have proven yourself yet again to be incapable of doing that."

"Mr. President, you’re right about one thing: the American people are tired. They’re tired of your lies about this virus," Biden said in a written statement. "They’re tired of watching more Americans die and more people lose their jobs because you refuse to take this pandemic seriously. Now, more than ever, we need a leader to bring us together, put a plan in place, and beat this virus — but you have proven yourself yet again to be incapable of doing that."

- (10/22) Distressing Thursday – CDC Concerned About US Virus Trends

- (11/3) Terrific Tuesday – Futures Fly Higher as Trump Error Comes to a Close

- (11/5) Federally Fueled Thursday – Fed Stimulus Hopes Lift Markets Higher

- (11/10) Ten Million Infections Tuesday – Just in Case You Forgot About the Pandemic…

What is most significant about that last one is that November 10th was just 51 days ago and now we're at 20M. While we are thrilled there is a vaccine – so far only 3M people have been given it and, 51 days from now, we could have 20M more infections to deal with. This isn't over folks – not by a long shot!

What is most significant about that last one is that November 10th was just 51 days ago and now we're at 20M. While we are thrilled there is a vaccine – so far only 3M people have been given it and, 51 days from now, we could have 20M more infections to deal with. This isn't over folks – not by a long shot!

- (11/11) Record High Wednesday – Dow 30,000 in Sight

- (11/19) Fragile Thursday – Market Reminds Us How Quickly it can Fall

- (11/23) Monday Market Movement – More Vaccines Boost Futures – Again

- (11/25) Which Way Wednesday – To Infinity and Beyond?

- (12/1) Turnaround Tuesday – More Stimulus Rumors as Powell Speaks

MORE FREE MONEY!

That's what this economy is based on and that's what the people expect. The way we make money in America is by MAKING MONEY – literally printing it and giving it away like… money. I was going to say like candy but you can't create candy out of thin air so, if you tried to give away $6Tn in a year, you would go bankrupt and create sugar and labor shortages and even Bazooka Joe would run out of ideas for clever cartoons on the wrapper. But MONEY – that is created by simply flipping a switch at the Fed that adds another zero to the balance sheet.

Since 2008, our National Debt has climbed from a shocking $8Tn to what is a now a "Who gives a f*ck anymore?" $27Tn and, whether now or next quarter, the market is execting AT LEAST $2Tn of additional stimulus and at least $2Tn of additional debt in 2021 (there's no way to stop Trump's fiscal-year budget now) so we'll be over $30Tn in debt by the end of Q1 – more than 150% of our GDP. How long do you think this can go on?

- (12/3) 3,000 Death Thursday – It’s Like 9/11 Every Day!

- (12/8) Trade of the Year Tuesday – Who Will Survive the Fall?

- (12/14) Monday Market Movement – Up and Up into the Holidays

- (12/16) Which Way Wednesday – 3,700 Fed Edition

- (12/18) Financial Failure Friday – Dollar Dips Below 90 as BitCoin Tops $23,000

- (12/22) 0.9 Trillion Dollar Tuesday – Another 5% of our GDP is Stimulus

- (12/29) Toppy Tuesday – More Free Money Helps Us Re-Test the Highs

And here we are – at the end of a very long, very strange year. Hopefully Powell is right and the Fed will never run out of firepower and hopefully Fauci is wrong and 100,000 new cases every eight hours won't be a big deal and hopefully I'm wrong and investors never wake up and face reality but, just in case, we do have our hedges and, for now, that's all we can be sure of into the new year.

Wishing you and your family a happy and HEALTHY New Year – let's hope 2021 is a big improvement and we can all forget about 2020!